Responsible Capitalism

Welcome to the ECGI content collection on the topic of Responsible Capitalism.

We define 'Responsible Capitalism' as an economic system that accommodates private ownership and the pursuit of market opportunities while achieving societal goals.

Here you will find a collection of content related to this theme, starting with our working papers. To discover more about our Responsible Capitalism initiative, visit our Project section. 👇

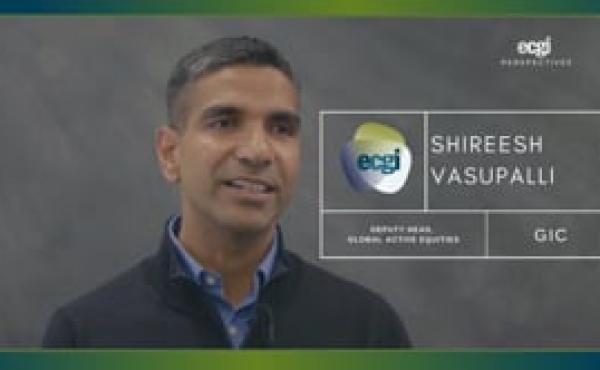

The Responsible Capitalism Initiative

Visit our project page to discover more on this topic, including reports and interviews.