New Beginnings

Issue 17 | January 2025

Greetings from Brussels!

Welcome back to another ECGI newsletter. The new year marks not just a time for new beginnings but, unfortunately, also some endings, as this will be the last ‘In Focus’ newsletter that I have the privilege to write.

In these newsletters, I have focused on applying fundamental research to some of the most important challenges of the future. With this final issue, I want to take a moment to look back and reflect on the fascinating and complex themes we’ve explored together.

Evolution of a controversial framework

Under the theme of responsible capitalism, I re-evaluated the role businesses and markets play for the well-being of the world. Such a subject brings with it a flood of terminology and buzzwords, often ideologically charged and interpreted in a variety of ways.

For instance, ESG — a term initially chosen instead of sustainability to present a value-neutral concept — has evolved into a highly controversial topic. Among the readers of this newsletter, there was an even split between those viewing ESG as a tool to achieve long-term shareholder value and those believing it contains a stronger values component, focusing on broader societal benefits.

The role of investors

>From terminology I turned to practice and explored the role of investors in driving meaningful change in a series of newsletters. I examined systematic stewardship, which assumes that large, diversified funds have an interest in shaping outcomes that benefit their portfolios in the long run, for example by reducing climate risk, even if this requires sacrifices for individual companies.

If investors indeed want to influence corporate outcomes to reduce negative externalities, is it better to voice their concerns or exit through divestment? The vast majority of readers agreed that investors have an important role to play in addressing climate risk and almost 80% favored voicing concerns over divestment.

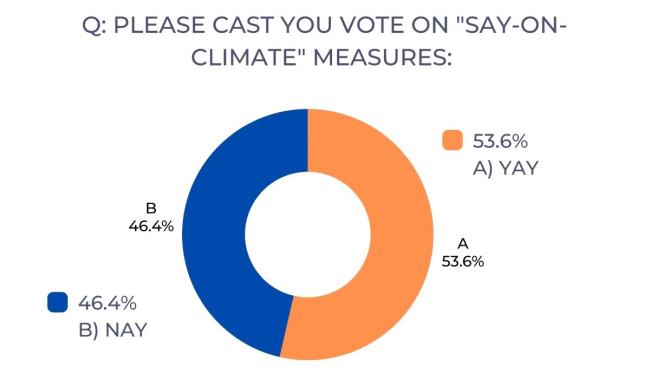

However, investors face significant obstacles when attempting to make their voices heard. In many jurisdictions there is legal uncertainty about the extent to which shareholders can influence a company’s climate strategy, exacerbated by rising political tensions and restrictions from courts and supervisors. 70% of readers felt that regulation should better support ESG shareholder proposals. Could explicit votes on ESG topics, such as ‘say-on-climate’, provide a solution? While these votes formalize shareholder input, they risk becoming rubber-stamping exercises that fail to capture nuanced debates.

Adding more and more pieces to the puzzle

Corporate behavior is naturally influenced by a variety of factors, which I explored in a number of different newsletters.

In jurisdictions dominated by controlling shareholders, corporate dynamics shift significantly. Understanding who these controlling shareholders are and what motivates them is a crucial piece of the puzzle. Another potential force to reckon with is retail investors. A blend of new technologies, a new generation of investors, and a growing discontent with societal issues led me to wonder if retail investors could revolutionize corporate governance and make public companies more responsive to social concerns? A majority of readers felt this behavior would remain a niche phenomenon.

I also tried to wrap my head around the somewhat elusive concepts of corporate culture and values. To make these terms concrete and workable, clear examples that offer a framework for decision-making are needed.

I also asked if CEOs should take a stance on societal issues. Your opinions were split. While such stances can foster loyalty and community, they often lack the substantive changes required to back them up. And, as we currently experience, too tight bands between politics and business can be quite divisive.

In crypto markets, ‘techbro culture’ and serious governance issues raise questions about the need for increased regulation. Gender dynamics add another layer to the debate. Research suggests that women on boards improve environmental and social performance, and women-led funds are more engaged on these issues.

Regulatory barriers and incentives

Finally, I turned my attention to the role of legislators. Effective legislation sets boundaries to deter harmful behavior. Yet, when enforcement is weak, even rational actors may choose to break the rules. I discussed the recalibration of directors’ oversight duties as one mechanism to enhance accountability.

Legislation can also send misleading signals, such as when it encourages compensation as an alternative to emission reduction. I questioned whether voluntary carbon markets are genuinely ‘additional’ and criticized the focus on scaling up global carbon removal markets, which diverts attention from the more pressing issue of cutting emissions.

I also investigated corporate transition plans, examining how to distinguish credible commitments from empty promises. Research shows that both internal and external corporate governance are crucial in driving meaningful commitments.

Again and again, research points to the benefits of corporate governance in addressing the complex issues of our time. So why not further regulate sustainable corporate governance? This was the initial idea behind the EU’s CSDDD, which aimed to align companies’ interests with those of management, shareholders, stakeholders and society. What began as a ‘sustainable corporate governance’ initiative ended up being anything but that. Nevertheless, the CSDDD remains groundbreaking, both for the shift in strategy it represents and the resilience of those who fought to prevent its failure.

A final note

And that is the note I want to end on. Even within an imperfect system and with imperfect tools, countless individuals strive to create meaningful change. They identify flaws and propose solutions. Science’s role is not only to question but also to inspire action, and taking action that is what I hope to do next.

Thank you for following along, for your insightful questions, comments and support. I would be delighted to stay in touch.

Cordially yours,

~ Marleen

PREVIOUS POLL RESULTS...

PREVIOUS ISSUES OF IN FOCUS...

Issue #16 - Cast Your Vote On Climate (November 2024)

Issue #15 - Conflicting Cultures (October 2024)

Issue #14 - Commitment Issues (June 2024)

Issue #13 - Shareholder (Dis)empowerment (May 2024)

Issue #12 - Crypto and Catastrophic Governance (April 2024)

Issue #11 - CSDDD – Too big to fail? (March 2024)

Issue #10 - Compensate or abate? (February 2024)

Issue #9 - CEO Activism (January 2024)

Issue #8 - Does it (still) pay off to pollute? (November 2023)

Issue #7 - Mind the Gender (Eco) Pay Gap (October 2023)

Issue #6 - KPop and Meme Stock (September 2023)

Issue #5 - Exit or Voice? Time to take stock (June 2023)

Issue #4 - Controlling Shareholders (May 2023)

Issue #3 - Practicing Systematic Stewardship (April 2023)

Issue #2 - The Who, What and Why of ESG (March 2023)

Issue #1 - Responsible Capitalism (February 2023)