Shareholder (Dis)empowerment

Issue 13 | May 2024

Greetings from Brussels.

It is finally spring here in Brussels and that means it is also once again time for the season of annual general meetings (AGM). Shareholder meetings are a forum for exchange on traditional corporate topics, but a growing number of shareholders also view it as an opportunity to take environmental, social, and political matters into their own hands.

Over 500 annual shareholder proposals on environmental and social topics have become the new baseline in the US. While a majority of them make it to a vote, support only averages at around 20-30%. Climate change makes up the largest part of those proposals, requesting transition planning, emissions targets, and reporting. The upcoming US presidential elections naturally dominate the political influence proposals, which seek clarity about election contributions and lobbying. Other contentious issues on the agenda are human rights, diversity, working conditions, and environmental questions, such as biodiversity.

Proposals tend to be submitted by ESG specialists, such as socially responsible asset managers and ESG funds, but also individuals, unions and religious organizations. Public pension funds and some large asset managers used to be on the list of supporters, but political tension and legal changes regarding their fiduciary duties have had a chilling effect. Several states have even prohibited their pension funds from considering ESG factors in their votes and investments.

Political backlash from legislators is not the only obstacle these shareholders face. The SEC allows a company to exclude shareholder proposals related to ‘ordinary business operations’, as the discussion of such topics at the AGM would be impractical. It loosened its stance on the inclusion of ESG topics in 2021, which led to a rise in ESG proposals. This year, however, the requests by companies to exclude proposals have surged and so have the exclusions that were granted.

The SEC is furthermore working on amendments that may prevent the resubmission of unsuccessful proposals on the same topic, a strategy employed by shareholder activists to gradually build support among investors and keep pressure on the company. The long-awaited SEC climate disclosure rule, adopted in March, fell short of ESG enthusiasts’ expectations, as it does not require companies to disclose Scope 3 emissions.

Another big threat to ESG shareholder proposals comes not from legislators or regulators, but from the courts. Earlier this year, ExxonMobil sued two of its investors for repeatedly submitting shareholder proposals calling on the company to disclose its Scope 3 emissions and speed up its emission reduction. By bypassing the regular exclusion request with the SEC, Exxon hopes to get judicial clarity on the boundaries for climate-change-related shareholder proposals and likely also aims to dissuade other shareholders from submitting similar proposals for fear of becoming subject to lengthy and expensive legal proceedings. Last week the judge ruled that the case against the US-based shareholder could move forward. Although the final outcome remains uncertain, the opinion issued so far gives reason to believe that the US might see fewer ESG activist proposals in the future.

Turning the attention to Europe we see far fewer ESG shareholder proposals to begin with. This is however not due to a lack of appetite for sustainability, but an interplay of several reasons.

ESG-related shareholder proposals often demand more disclosure from their companies. EU legislation already requires companies to disclose rather detailed sustainability information and these requirements have been recently widened again. Both the disclosure of Scope 3 emissions and transition plans, the request for which Exxon is suing its shareholders, are for example mandated by EU law.

Another set of reasons has to do with shareholder competences, rather than their stance on sustainability. While shareholders in the EU have the right to propose agenda items and draft shareholder resolutions, this right is only granted to shareholders with at least 3-5% of share capital. As I discussed in a newsletter last spring, share ownership tends to be less diversified in European companies, making shareholder engagement more challenging overall. Submitting shareholder proposals can be particularly difficult as they are limited to topics deemed to be a competence of the shareholder meeting. Directors have the right to refuse other topics and they tend to do so for climate policy proposals, as they view it as a question of strategy, which is a board competence. Shareholders have nonetheless introduced climate-related topics for non-binding votes instead, but this ‘circumvention’ of shareholder competencies has been met with resistance from the courts.

Some of these dynamics may change in the future, as legislation has been introduced in several European countries that will affect governance and shareholder voting. Switzerland now requires larger companies to hold a vote on the company’s non-financial reports, Sweden and Austria allow virtual AGMs and Germany has reintroduced shares with multiple voting rights. Recent updates to corporate governance codes aim to improve the company-shareholder dialogue, introduce ESG considerations, and link them to corporate purpose and executive compensation.

Investors globally continue to push for ESG, although their motivations and methods may differ. Whether it is a Sisyphean task or not is directly linked to the response by the respective jurisdictions.

What regulatory response would you favor? Let me know in the poll below.

Cordially yours,

Marleen

MINI POLL

Q: Should regulation be more accommodating of ESG shareholder proposals?

A) Yes, many ESG topics are of relevance to shareholders, so the barrier for them to submit proposals should be low.

or

B) No, shareholder competences already accommodate shareholders’ needs sufficiently. Where necessary, ESG topics should be regulated directly.

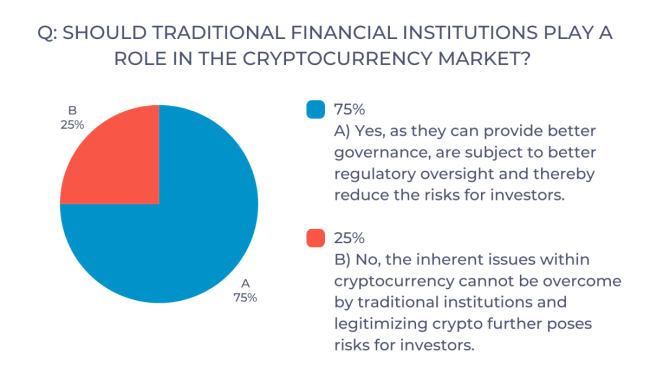

LAST MONTH'S POLL RESULTS...

MORE FROM ECGI...

SELECTED WORKING PAPERS:

PREVIOUS ISSUES...

In Focus Newsletter

Issue #11 - CSDDD – Too big to fail? (March 2024)

Issue #10 - Compensate or abate? (February 2024)

Issue #9 - CEO Activism (January 2024)

Issue #8 - Does it (still) pay off to pollute? (November 2023)

Issue #7 - Mind the Gender (Eco) Pay Gap (October 2023)

Issue #6 - KPop or Meme Stock (September 2023)

Issue #5 - Exit or Voice? Time to take stock (June 2023)

Issue #4 - Controlling Shareholders (May 2023)

Issue #3 - Practicing Systematic Stewardship (April 2023)

Issue #2 - The Who, What and Why of ESG (March 2023)

Issue #1 - Responsible Capitalism (February 2023)

Marleen Och is a PhD researcher at KU Leuven, Belgium.

She works in the field of sustainable finance and corporate governance, writing about shareholder engagement and sustainability.

Please feel free to get in touch, share your thoughts and let us know how we're doing, email Marleen.Och@ecgi.org and follow us on Twitter at @ecgiorg