Crypto and Catastrophic Governance

Issue 12 | April 2024

Greetings from Brussels.

After last month’s newsletter on the infamous CSDDD, I’m back again with another hot topic involving corporate governance and somewhat dubious acronyms. Let’s talk about FTX and SBF.

While the majority of the drama involving the crypto exchange platform FTX and its founder Sam Bankman-Fried (SBF) already played out in 2022, the recent verdict for SBF and simultaneous crypto boom give reason to revisit this story. And after all, I couldn’t really write a newsletter for the European Corporate Governance Institute without addressing one of the biggest corporate governance failures to date.

FTX, once among the largest cryptocurrency exchanges globally, collapsed in 2022 after just 3 years of existence, following what could be described as the crypto version of a bank run.

It’s founder and former CEO SBF was sentenced to 25 years in prison last month for misappropriating billions of dollars from customers and defrauding investors and lenders. His trial brought a spectacular amount of governance failures to the surface. The statements of FTX’s current CEO John J. Ray III, who had worked previously on the aftermath of the Enron scandal, likely made some crypto sceptics and good governance enthusiasts feel slightly vindicated.

He called out the ‘complete failure of corporate controls’, the ‘complete absence of trustworthy financial information’, and the ‘compromised systems of integrity and faulty regulatory oversight abroad’. Rather than establishing a decentralized system, as is the original idea with cryptocurrencies, FTX created almost the opposite, leaving control over the money ‘in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals’.

The company barely had any basic risk management or oversight practices in place; lacking independent board members, regular board meetings or even proper auditing, accounting and data protection mechanisms.

While most would agree that this sounds appalling, the question of whether crypto is the root cause or rather a possible solution to such governance problems, is more complex and divisive. While some characteristics of cryptocurrency and blockchain technology can reduce governance obstacles, such as lowering contracting costs, others, like information asymmetry, get amplified, as we’ve seen with the example of FTX.

One of crypto’s biggest promises is the concept of a decentralized system that uses cryptography and blockchain technology for record-keeping, thereby avoiding the centralized power that banks hold in mainstream finance.

Unfortunately this idea leaves no room for human error, like forgetting your password or accidentally throwing away an external hard drive. Crypto intermediaries overcome this issue, but have in turn created an even more centralized, but less transparent alternative, where power falls in the hands of a few founders and developers at the core of a few companies. These blockchain conglomerates naturally arise due to network externalities, economies of scope, and first-mover advantages.

Regulation of the crypto industry is rising and interest in it by the mainstream financial industry is growing, indicating its wild west days may come to an end. Yet, critics warn that placing cryptocurrencies into a regulated instrument such as an ETF merely adds a different packaging around what remains a highly volatile market, mainly based on ‘vibes’. Others even suggest that crypto should be kept completely separate from traditional finance and rather be regulated like gambling.

SBF’s 25-year prison sentence is just one of many recent court cases shaking up the crypto world. While one could expect this to again cool down the market, the opposite is true. Bitcoin is currently at a record high, also thanks to Bitcoin ETFs, offered by BlackRock, Fidelity, and other major financial institutions.

Another notable record high can be observed in relation to the large-scale lobbying campaign the crypto industry has rolled out ahead of the US elections. While schmoozing up to politicians doesn’t really match the anti-establishment image that the crypto industry likes to present itself with, it isn’t all too surprising that they chose this way forward to deter future regulation.

I for one remain a crypto sceptic, but I am curious whether this recent boom will also bring with it some new innovation and may even deliver fresh solutions to old corporate governance problems.

What is your stance on crypto? Let me know in the survey below.

Cordially yours,

Marleen

MINI POLL

Q: Should traditional financial institutions play a role in the cryptocurrency market?

A) Yes, as they can provide better governance, are subject to better regulatory oversight and thereby reduce the risks for investors.

or

B) No, the inherent issues within cryptocurrency cannot be overcome by traditional institutions and legitimizing crypto further poses risks for investors.

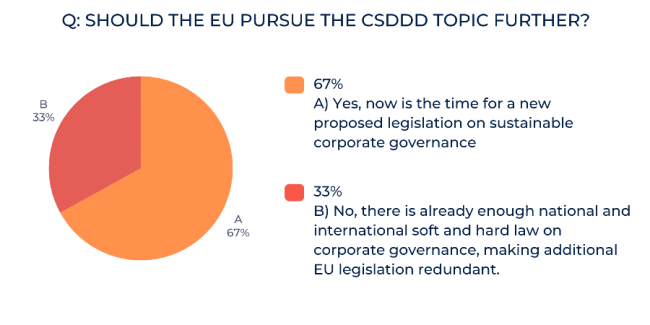

LAST MONTH'S POLL RESULTS...

MORE FROM ECGI...

SELECTED BLOG POSTS:

SELECTED WORKING PAPERS:

PREVIOUS ISSUES...

In Focus Newsletter

Issue #11 - CSDDD – Too big to fail? (March 2024)

Issue #10 - Compensate or abate? (February 2024)

Issue #9 - CEO Activism (January 2024)

Issue #8 - Does it (still) pay off to pollute? (November 2023)

Issue #7 - Mind the Gender (Eco) Pay Gap (October 2023)

Issue #6 - KPop or Meme Stock (September 2023)

Issue #5 - Exit or Voice? Time to take stock (June 2023)

Issue #4 - Controlling Shareholders (May 2023)

Issue #3 - Practicing Systematic Stewardship (April 2023)

Issue #2 - The Who, What and Why of ESG (March 2023)

Issue #1 - Responsible Capitalism (February 2023)

Marleen Och is a PhD researcher at KU Leuven, Belgium.

She works in the field of sustainable finance and corporate governance, writing about shareholder engagement and sustainability.

Please feel free to get in touch, share your thoughts and let us know how we're doing, email Marleen.Och@ecgi.org and follow us on Twitter at @ecgiorg