ECGI Reports

A collection of ECGI Reports from events and project related activities.

2023

-

Management and Governance: Effective corporate purpose must be clearly defined, integrated into the firm’s strategy, and resonate throughout the organization. It should not be conflated with ESG, but rather it should connect with company strategy, policies, and business models while nurturing core values.

- Ownership: Ownership structures play a significant role in shaping corporate purpose. Different structures, such as foundations, family businesses, and institutional investors, have varying impacts. Foundations are generally more likely to instill a robust corporate purpose, while family businesses may underperform regarding sustainability.

-

Finance and Investment: Investors, especially institutional ones, are crucial in supporting corporate purpose through stewardship activities. However, the idea of 'purpose before profit' can conflict with fiduciary duties. Stewardship codes help bridge this gap, allowing for a broader view of corporate purpose that includes ESG factors.

-

Law: Legal frameworks can either enable or hinder corporate purpose. Laws provide accountability for companies that create negative externalities and can support corporate purpose by ensuring legal consequences for misleading practices. Mechanisms such as shareholder inspection rights and whistleblowing facilitate this accountability.

- Measurement and Metrics: Measuring corporate purpose is challenging but essential. Companies are developing new metrics, often linked to ESG, to gauge their impact on society and the environment. Standardized metrics are particularly needed for climate-related issues, whereas social issues may require more flexible, company-specific metrics.

-

Inconclusive Evidence on Short-Termism: The empirical evidence on corporate short-termism is inconclusive. Policymakers often conflate corporate short-termism with broader social issues, but the actual data does not support the narrative of a severe, widespread short-termism problem.

- Executive Compensation Complexity: The relationship between executive compensation and short-termism is complex. While some forms of long-term incentives (LTIs) can align executive interests with long-term company performance, other structures, particularly those tied to short-term financial metrics, can exacerbate short-termism.

-

Role of Controlling Shareholders: Controlling shareholders can both mitigate and exacerbate short-termism. They can prevent short-term pressures from influencing management but may also prioritize short-term gains for personal liquidity needs. The impact largely depends on the nature of the controlling shareholders and their long-term incentives.

-

Loyalty Shares as Control Mechanisms: Loyalty shares, intended to promote long-term investment, often serve as control-enhancing mechanisms for existing controlling shareholders. This can lead to a concentration of control without necessarily improving long-term company performance or increasing IPO activity.

- Quarterly Reporting Debate: The reform of quarterly reporting requirements to combat short-termism is contentious. While reducing reporting frequency might theoretically promote long-term thinking, there is little evidence that it effectively reduces short-term pressures. Additionally, voluntary reforms have minimal impact as markets may view less frequent reporting negatively.

-

Scope Expansion and Firm Valuation: U.S. firms have significantly expanded their operational scope over the past 30 years, primarily through acquisitions and R&D investments rather than capital expenditures. This scope expansion has notably increased firm valuation, revealing a new type of firm highly valued by the market.

- Patent Expirations and Merger Waves: The expiration of patents can trigger merger waves within industries. These merger waves, driven by upcoming patent expirations, tend to result in deals with lower announcement returns and higher target premiums, followed by declines in acquirer performance and investment opportunities.

-

Escrow Contracts in Acquisitions: Escrow contracts are commonly used in acquisitions involving high transaction risks, such as private targets and cross-industry deals. These contracts reduce transaction completion time and increase target valuation, benefiting both acquirers and bidders by lowering due diligence costs and litigation expenses.

-

Economic Volatility and M&A Strategies: Economic volatility has led many organizations to reassess their M&A strategies, with joint ventures and partnerships becoming more critical. Companies increasingly focus on the human aspects of M&A, such as team integration and talent management, and are incorporating Diversity, Equity, and Inclusion (DEI) metrics into target assessments.

- International Migration and Cross-Border M&As: Higher inbound migration can positively impact cross-border M&As by reducing cultural distance and facilitating post-merger integration. Migration helps mitigate information asymmetry between acquiring and target countries, leading to higher deal frequency, dollar value, and synergy gains.

2022

-

Global Stewardship Evolution: The report highlights the evolution of investor stewardship globally, noting the expansion from traditional corporate governance to include broader environmental, social, and governance (ESG) factors. This shift reflects an increasing emphasis on sustainability and accountability across the investment chain.

- Impact of Uncertainties: The report discusses how recent global uncertainties such as the COVID-19 pandemic, climate change, and geopolitical conflicts have influenced investor stewardship. These challenges have prompted investors to reconsider their strategies and the role of stewardship in mitigating systemic risks.

-

Diverse Approaches to Stewardship: Different jurisdictions approach stewardship in varied ways, influenced by their unique corporate governance structures. For example, the UK's approach emphasizes institutional ownership, while countries like Singapore focus on family ownership and have even developed a Family Stewardship Code.

-

Integration of ESG in Stewardship Codes: The report highlights the increasing integration of ESG considerations into stewardship codes. The UK Stewardship Code 2020, for instance, expands its scope to address systemic risks like climate change, promoting a well-functioning financial system.

- Technological Disruption: The impact of disruptive technologies on investor stewardship is explored, particularly in how technology can both empower and challenge investors. Innovations in areas like AI and climate modeling are transforming risk assessment and engagement strategies, highlighting the need for investors to adapt to technological changes in their stewardship practices.

2021

-

Machine Learning Assessment of Climate Risk Disclosures: Professor Eric Talley’s study applies machine learning to identify climate-related disclosures in corporate reports, combining data on temperature, weather events, and litigation. It aims to guide which companies should disclose climate risks under SEC mandates, emphasizing the potential for enhanced transparency. The effectiveness of these tools, however, hinges on whether the SEC deems carbon reduction financially material.

- Making Corporate Carbon Commitments Credible: Professors Armour, Enriques, and Wetzer discuss the motivations behind climate pledges by significant carbon emitters (SICEs), ranging from genuine business interest to potential greenwashing. They propose 'Green Pill' debt instruments to penalize firms that fail to meet climate commitments, promoting credible, financially backed climate targets.

- Exit vs Voice in ESG Investing: Professor Oliver Hart and colleagues analyze ESG investor strategies, concluding that while divesting has minimal market impact, active engagement with management is more effective. They suggest voting and engaging on climate issues as more impactful than merely divesting, offering a preferred strategy for committed ESG investors.

- Panel Discussion on ESG Implementation by Institutional Investors: A panel explored the implementation of ESG strategies by institutional investors, identifying discrepancies in ESG adherence among UNPRI signatories. It called attention to the need for public policy support, the difference between engagement (voice) and divesting (exit), and advocated for standardized ESG criteria to enhance effectiveness.

- Climate Change Governance by Boards of Directors: Professor Brett McDonnell and co-authors reviewed tools under US and Australian corporate and securities laws for managing climate risks through disclosure and shareholder engagement. The panel stressed the need for stronger reforms and better enforcement, suggesting unified disclosure standards and emphasizing stakeholder values to ensure effective governance and accountability.

2020

-

Workshop Overview: ECGI and the Impact Economy Foundation (IEF) hosted a workshop in response to the IFRS Foundation's consultation on global sustainability standards. The discussion focused on the need for a new Sustainability Standards Board (SSB) to achieve global consistency and reduce complexity in sustainability reporting, with an initial focus on climate-related information.

-

Academic Insights: Christian Leuz emphasized the need for standardized and mandatory sustainability reporting. He highlighted two main goals: providing investors with desired information and driving change through sustainability reporting. He pointed out the trade-offs between financial materiality and addressing major environmental concerns, stressing the importance of understanding investor motivations.

-

Corporate and Investor Perspectives: Sandy Boss from BlackRock and Bob Eccles from Oxford University discussed the importance of sustainability disclosures in investment decisions. They highlighted the need for comparable, high-quality data and the potential of IFRS Foundation to establish a global reporting standard. Eccles also mentioned the systemic effects and the trend towards engagement and stewardship.

-

EU's Role and Challenges: Alain Deckers of the European Commission noted the fragmentation in sustainability reporting standards and the need for global standards to ensure reliable and relevant information. The EU's existing legal framework and the IFRS Foundation's reputation and governance structure were seen as strengths for developing these standards.

- Enforcement and Future Directions: Steven Maijoor of ESMA and Tajinder Singh of IOSCO emphasized the importance of enforceable, principle-based international standards to prevent issues like greenwashing. They called for building on existing work and ensuring broad stakeholder engagement. The session concluded with the recognition of the need for clear, common standards and a holistic approach to sustainability reporting.

-

Misconception of the Problem: The report erroneously defines corporate short-termism as damaging to the environment, climate, and stakeholders by conflating it with externalities and distributional concerns. Solutions for one issue might exacerbate others, indicating a misunderstanding of the distinct problems.

- Flawed Evidence of Short-Termism: The report's main evidence for increasing short-termism, rising gross payouts to shareholders, is misleading. Net payouts (gross payouts minus equity issuances) provide a more accurate measure and show that sufficient funds remain for long-term investments.

-

Selective Use of Literature: The report selectively references academic studies that support its views on short-termism, ignoring substantial literature that contradicts these views. This biased use of literature undermines the credibility of the report’s conclusions.

-

Misleading Measures and Analysis: The report’s analysis of investment trends is based on incomplete and inconsistent data. It excludes relevant companies and relies on misleading statistics, which do not accurately reflect the ability of companies to invest in long-term projects.

- Questionable Reform Proposals: The proposed reforms targeting short-termism are based on potentially flawed premises and may not address the actual problems. The report fails to clearly articulate the real issues of externalities and distribution, casting doubt on the suitability of its recommended solutions.

-

Short-Termism in Corporate Decision-Making: The EY Report identifies that EU companies often prioritize short-term shareholder interests over long-term company sustainability. This focus neglects sustainability risks and impacts, prompting the need for legislative changes to align corporate strategies with long-term sustainability goals.

- Drivers and Solutions for Short-Termism: The report lists seven drivers, twelve issues, and thirty-six policy options to address short-termism. However, some experts argue that these measures may not effectively target the root causes of the problem, such as investor pressures for short-term gains.

-

Critique of the EY Report's Evidence: Several scholars criticize the EY Report for using biased samples and misinterpreting data. They argue that shareholder payouts are not as high as claimed when considering equity issuances, and that investment intensity among EU firms has actually increased, suggesting the EY Report's conclusions are flawed.

-

Alternative Approaches to Address Short-Termism: Experts propose alternative solutions, such as enhancing ESG measurement and disclosure, promoting long-term board compensation, and facilitating shareholder engagement. They caution against legislative changes that might inadvertently harm long-term sustainability by focusing too narrowly on short-termism.

- Role of Gender Diversity in Sustainability: The report also touches on the positive impact of gender diversity on corporate boards. Research indicates that a higher presence of female directors correlates with increased renewable energy consumption and overall firm sustainability, suggesting that improving board diversity could be a more effective approach than altering directors' duties.

-

Importance of SMEs and Family Businesses: Valdis Dombrovskis, Executive Vice-President of the European Commission, highlighted that SMEs and family businesses are critical to Europe's economy, comprising 70% of enterprises and employing 100 million people. The European SME strategy aims to reduce barriers, improve financing, and foster digital and green transitions.

- Family Firms' Resilience and Governance: Professor Morten Bennedsen discussed the unique assets of family firms, such as value-based leadership and resilience. However, he also noted governance challenges, particularly when family members lack accountability, using the Sackler family as an example.

-

Decline in Public Listings: A panel noted the decline in public listings of family firms in the Baltics despite the importance of equity markets. Structural issues, such as market classification and visibility to institutional investors, contribute to this trend, alongside a preference for alternative financing like private equity and venture capital.

-

Impact of Shareholder Liquidity on Firms: Professor Janis Berzins presented research indicating that personal liquidity shocks to controlling shareholders adversely affect firm behavior, leading to increased dividend payouts at the expense of growth and performance. This highlights the interconnectedness of personal and corporate financial health.

- Family Control Without Ownership: Professor Vikas Mehrotra showed how founding families in Japanese firms maintain control without significant ownership through mechanisms like talent retention, cross-shareholdings, and adult adoptions. This challenges traditional views of family firm dynamics and emphasizes the diverse methods of sustaining family influence.

-

SMEs and Economic Recovery: The importance of small and medium enterprises (SMEs) for economic recovery was emphasized. Despite having lower cash reserves and limited access to credit, SMEs are more flexible and less integrated into the global supply chain. Initiatives to support SMEs include expanding the ECB's asset purchase program and adapting the regulatory framework to prevent a collapse in lending to SMEs.

- Corporate Purpose and Governance: The role of corporate purpose, ownership, and governance in responding to the pandemic was highlighted. Long-term owners play a crucial role in balancing stakeholders' interests, and gender diversity was noted as beneficial due to empathetic traits in women leaders. The introduction of profit measures that capitalize on human, social, and natural capital was also recommended.

-

Legal and Regulatory Adjustments: Key areas of corporate law need to be adjusted to help corporations during the crisis, including relaxing requirements for issuing new equity or debt and applying laxer director liability standards. Temporary takeover defenses were suggested to protect companies from hostile bids.

-

Federal Reserve's Response: The Federal Reserve's unprecedented intervention to stabilize credit markets and support the economy was praised. Recommendations included creating a standing fund for emergency lending and regulating shadow banks. The importance of supporting small and midsize enterprises was emphasized, as they constitute a significant portion of GDP and employment.

- Crisis Management and Innovation: Effective crisis management requires having a trusted team and relying on company values. Supporting employees first and then customers is crucial. The crisis presents an opportunity for government and business collaboration to innovate and address societal problems. Embracing inclusion and adapting to new business realities, such as managing a remote workforce, were also discussed.

-

Divestment vs. Engagement: The conference debated the effectiveness of divestment, questioning its direct impact on share prices while recognizing its potential to influence branding, policy, and public opinion. It was suggested that engaging with companies, particularly in the oil and gas sector, to shift their capital expenditure towards low-carbon technologies might better address climate change.

- Case Studies and Academic Insights: The event featured a case study on climate-change activism at the University of Cambridge and an academic paper on the discrepancies in ESG ratings. These discrepancies were highlighted as significant, given their impact on stock returns and the differing methodologies of rating providers.

-

Importance of ESG Ratings: It was noted that while sustainable or low-carbon funds attract investments, there is a stark contrast in the consistency of ESG ratings compared to traditional credit ratings like those from Moody's and S&P. This inconsistency necessitates a deeper understanding of the methodologies behind ESG ratings.

-

Active Engagement: Evidence was presented supporting active engagement by institutional owners as a means to achieve positive outcomes. This was demonstrated through case studies and a quasi-natural experiment on Norway’s sovereign wealth fund influencing governance practices.

- Collaboration and Future Prospects: The conference also discussed the impact of coordinated efforts by activist shareholders on ESG issues and included a panel discussion on the future of the finance industry's response to ESG concerns. Collaborative actions and international networks were shown to play a critical role in influencing investee companies.

-

Diverse Ownership and Corporate Governance: The report emphasizes the importance of understanding the heterogeneity and diversity of ownership. It highlights that the different nature of shareholders has a significant impact on corporate governance, including decisions related to board composition, board dynamics, CEO hiring and firing, strategy making, and incentives design.

- Impact of Common Ownership: The discussion on common ownership underscores its potential effects on market competition and corporate behavior. It explores the dual hypotheses of market power and efficiency gains, suggesting that common ownership might lead to reduced competition but also improved information sharing and internalization of externalities.

-

CEO Compensation and Short-Termism: The report addresses the issue of short-term incentives for CEOs, particularly how equity vesting can lead to a decrease in long-term investments. It also discusses the challenges of aligning CEO compensation with long-term corporate health, suggesting reforms such as performance-based vesting and post-employment shareholding requirements.

-

Trust-Based Corporate Models: Colin Mayer's presentation advocates for a shift from shareholder primacy to a trusteeship model, where the board manages the corporation in the interest of all stakeholders. This model is argued to potentially result in more engaged employees and customers, and less need for external regulation due to internalization of societal issues.

- Policy Recommendations and Corporate Purpose: The conference discussions also included recommendations for policy changes to support a more purpose-driven approach to corporate governance. This includes defining the corporation's purpose beyond profit maximization to address societal and environmental problems, thereby creating long-term value for all stakeholders.

2019

-

Annual Lecture on Firm Culture: The meeting featured an annual lecture by Professor Paola Sapienza, focusing on "The Economics of Firm Culture". Sapienza discussed how corporate culture affects economic outcomes and provided examples from companies like Siemens and Amazon to illustrate the significance of firm culture in shaping corporate behavior and performance.

- Panel Discussion on Corporate Culture: A panel discussion followed Sapienza's lecture, moderated by Professor Marco Becht. The panel highlighted the challenges and importance of fostering a positive corporate culture across diverse companies. Beatrice Engström-Bondy emphasized the role of dialogue and network in creating a cohesive corporate culture within large groups.

-

Best Paper Awards: The ECGI awarded prizes for the best papers in Finance and Law Working Paper Series from the previous year. The Finance Series prize went to a paper on "Investor Ideology" by Professors Bolton, Li, Ravina, and Rosenthal. The Law Series prize was awarded to Professors Bebchuk and Hirst for their paper on "Index Funds and the Future of Corporate Governance".

-

Corporate Governance Insights: Francisco Reynés Massanet delivered the after-dinner speech, discussing the evolving role of corporate governance. He stressed that corporate governance aims to ensure the longevity of companies by balancing profitability with broader societal impacts. Reynés also highlighted the critical relationship between the board and the CEO in achieving effective governance.

- Empirical Insights on Corporate Culture: Sapienza reviewed existing empirical literature on corporate culture, noting its thinness. She concluded that local culture significantly influences corporate culture and that stated corporate values often do not align with employee beliefs or firm performance. The lecture called for a new paradigm to better understand the unique aspects of corporate culture within firms.

-

Varied Stewardship Practices: The conference underscored that stewardship practices differ significantly across jurisdictions due to varying market structures, legal frameworks, and cultural factors. While stewardship codes often look similar, their functions and effectiveness vary widely depending on the local context.

- Role of Institutional Investors: Institutional investors play a crucial role in stewardship, but their influence and engagement levels differ by country. For example, in Germany, institutional investors hold a small fraction of market capitalization, reducing the potential impact of a stewardship code . In contrast, the South African Government Employees Pension Fund is a significant player in promoting responsible investment.

-

Regulatory Approaches: Different countries have adopted various regulatory approaches to stewardship. The UK pioneered with its 2010 Stewardship Code, focusing on long-term engagement and accountability. Other countries, like Japan and South Korea, have adapted their codes to fit their unique market conditions and governance structures.

-

ESG Integration: Environmental, social, and governance (ESG) considerations are increasingly integrated into stewardship codes. This trend is seen as essential for promoting sustainable investment practices and addressing systemic risks. The UK and South Africa have notably incorporated ESG factors into their stewardship frameworks.

- Challenges and Opportunities: The conference identified several challenges, including low engagement levels, the need for better reporting, and the potential for 'faux convergence,' where countries adopt stewardship codes for appearances rather than substantive change. Nonetheless, there are opportunities to refine and enhance stewardship practices to better align with global sustainability goals.

-

Heterogeneity in CSR Reporting: There are no universally agreed upon or mandatory CSR reporting standards, resulting in substantial heterogeneity in CSR disclosures. This makes it difficult for stakeholders to use and compare CSR information effectively, potentially hindering firms from fully benefiting from their CSR activities.

- Potential Benefits of Mandated Standards: Mandating a common set of CSR reporting standards for U.S. publicly listed firms could improve information for investors and other stakeholders, potentially enhancing capital market outcomes such as liquidity, cost of capital, and asset prices, especially if current compliance with existing regulations is low.

-

Real Effects on Firms: Firms are likely to respond to a CSR reporting mandate by altering their business operations and CSR activities. This could lead to better governance and reduced agency problems, but there might also be unintended consequences, such as the shift of certain harmful CSR activities abroad or to private firms.

-

Stakeholder Impacts: A wide range of stakeholders, including consumers, employees, and society at large, have legitimate interests in firms' CSR activities. Improved CSR reporting could benefit these groups, who typically have a more passive relationship with firms compared to investors.

- Implementation Challenges: Effective implementation of a CSR reporting mandate involves navigating societal, political, and moral debates, defining materiality for CSR information, avoiding boilerplate language, and ensuring credible enforcement. Significant investments in enforcement infrastructure and expertise are required to achieve substantive economic effects and shape managers' reporting incentives appropriately.

-

Decline in Public Listings: The number of US public companies has dramatically decreased from around 7,500 in 1997 to about 3,750 today. The decline is attributed to fewer initial public offerings (IPOs) and a continuous high rate of delistings, mainly through mergers rather than companies going private.

- Impact of Intangible Assets: The increased importance of intangible assets has made public markets less attractive for firms. Intangible assets are easier to finance privately, reducing the need for public financing. Additionally, the institutionalization of private equity has decreased the liquidity advantage traditionally offered by public markets.

-

Role of Regulation: While regulatory burdens like the Sarbanes-Oxley Act are often blamed for the decline in small public companies, the decrease in IPOs started before these regulations were implemented. Therefore, regulation alone cannot explain the reduced number of public firms.

-

Index Fund Monitoring: The rise of passive investing has impacted corporate governance. Index funds, which now hold 30% of US equities, are less incentivized to monitor firms actively. They tend to vote with management recommendations more frequently than active funds, due to the lack of performance-based compensation and the free-rider problem.

- Disclosure Standards: There is a growing need for better disclosure standards, especially concerning ownership, environmental, social, and governance (ESG) issues, and political contributions. Improved disclosure can enhance transparency and accountability, helping investors make more informed decisions.

-

Erosion of Trust and Business Purpose: Professor Colin Mayer highlighted a growing mismatch between current market and regulatory views on business and broader sustainability concerns. He argued for a reconceptualization of business purposes to focus on providing profitable solutions to societal and environmental problems, utilizing technology to enhance collective wellbeing rather than solely serving shareholder interests.

- AI and Corporate Governance: Professor John Armour discussed the impact of AI on corporate governance. While AI could improve productivity and competitive advantage, it also presents significant data governance challenges. Armour suggested that corporate law might need to evolve to address new types of agency costs associated with AI, requiring directors to understand AI risks and exercise due care in managing these technologies.

-

Management by AI: Dr. Martin Petrin explored the extent to which AI could manage business organizations, suggesting that AI is likely to take over administrative tasks but opinions vary on its role in non-administrative tasks like strategy and innovation. He predicted significant changes in corporate management, with an increasing intertwining of management with business analytics and IT programming.

-

Distributed Ledgers and Blockchain: Professor Christopher Bruner examined how emerging technologies like blockchain and AI could transform corporate governance. Distributed ledgers could enhance shareholder voting and reduce costs, while AI might automate board functions. However, Bruner noted that certain "soft" skills would likely remain under human control.

- Flexible Work and Employment: Dr. Marc Moore analyzed flexible work through the lens of Coase’s theory of the firm, emphasizing the need for appropriate compensation for the risks assumed by gig and casual workers. He highlighted the blurring lines between employment and non-employment, suggesting that traditional concepts of employment may need to evolve to address these new forms of work.

-

Regulatory Arbitrage: The Centros case significantly influenced regulatory arbitrage by granting companies the freedom to incorporate within the EU, which has been both praised and criticized. This decision limited the ability of states to control companies headquartered within their borders, thus raising concerns about potential abuse of this newfound freedom.

- Scope of Company Law in Regulatory Competition: The scope of company law now includes the ability for companies to select favorable legal environments (regulatory arbitrage) and for states to reform laws to attract or retain companies (regulatory competition). However, the impact on actual corporate mobility has been modest, suggesting that legal reforms have not drastically changed the landscape.

-

Creditor Protection Before and After Brexit: The UK's influence on corporate behavior within the EU was highlighted, especially regarding creditor protection. Brexit is expected to decrease the UK's dominance in the European corporate restructuring market, prompting further regulatory changes and harmonization efforts within the EU to ensure effective creditor protection.

-

Impact of Legal Reforms: Studies indicated that post-Centros legal reforms in Europe, such as reducing registration requirements, have impacted cross-border firm formation. Entrepreneurs are more likely to incorporate in jurisdictions with less stringent capital requirements, though broader corporate mobility remains limited.

- Legacy and Future Challenges: The Centros decision spurred regulatory competition and improvements in company law but also raised concerns about abusive practices. With Brexit, new challenges arise for maintaining the benefits of regulatory competition while safeguarding against potential risks. The ongoing development in corporate law will need to address these issues to continue fostering a balanced legal environment.

-

Event Purpose and Structure: The event aimed to foster educational discussions and debates between practitioners and academics on corporate governance and stewardship. It featured presentations and reviews of four papers, followed by discussions involving both academic and institutional perspectives.

- Common Ownership and Antitrust Risks: The first paper discussed the antitrust risks associated with common ownership, using the U.S. airline industry as a case study. The debate highlighted the potential for reduced competition and higher prices due to common ownership and called for further empirical research to inform policy initiatives.

-

Corporate Voting Behavior: The second paper examined the dynamics of shareholder voting, particularly the freerider and underdog effects, where contentious resolutions see higher participation from opposing voters. This research emphasized the need to consider these effects in the context of the new Shareholders Rights Directive in Europe.

-

ESG Engagement Impact: The third paper analyzed ESG (Environmental, Social, and Governance) engagement by investors, showing that such engagement can positively impact the financial performance of target companies. Factors contributing to successful engagements include the target company's market share and prior ESG scores.

- Coordinated ESG Engagements: The fourth paper focused on coordinated ESG engagements among investors, finding that collaborative efforts, especially those led by influential local investors with international support, are more likely to succeed. This approach improves both financial and accounting performance of target firms.

2018

-

Loyalty Shares Concept and Adoption: Loyalty shares aim to encourage long-term ownership by offering additional voting rights or cash-flow benefits to shareholders who retain their shares for a specified period. These shares have a long tradition in France, have been recently introduced in Italy, and are expected in Belgium. The U.S. has seen limited adoption, mainly through "time-phased voting" in a few companies and the Long-Term Stock Exchange (LTSE) project.

- Loi Florange and France's Experience: The Loi Florange in France changed the default rule to double voting rights for shares held for at least two years unless opted out by a two-thirds majority. The reform saw minimal impact on firm value and holding periods, suggesting that the default rules were not as influential as anticipated due to low transaction costs.

-

Differences from Dual Class Structures: Loyalty shares are distinct from dual class shares in that they involve a single class of shares, have non-perpetual extra votes, and the voting power varies with holding periods. They are considered less transparent than dual class structures, which can lead to complexity in calculating voting rights.

-

Challenges and Criticisms: Issues such as the difficulty for institutional investors to register for loyalty shares in Europe, the potential for these shares to entrench management, and the practical problems with securities lending were highlighted. Critics argue that loyalty shares might serve more as control-enhancing mechanisms rather than genuinely promoting long-termism.

- Future Prospects and LTSE Proposal: The LTSE proposes a more accessible and democratic voting system where shareholders accrue additional voting rights over time. The LTSE aims to address short-termism without entrenching management. The success of this system in the U.S. could provide a live experiment for evaluating the potential broader adoption of loyalty shares.

-

Enhanced Shareholder Engagement with DLT: Blockchain and DLT can address issues of unequal information distribution and multi-tiered intermediaries, thereby facilitating better shareholder engagement. These technologies can streamline voting processes, reduce proxy voting imbalances, and make share trading and settlement immediate. However, the full decentralization potential of DLT was debated, with questions about its feasibility and cost-effectiveness.

- Governance Challenges with AI: AI’s role in monitoring and simulation introduces data governance challenges, especially concerning data sourcing, metric selection, and external data validity. AI can assist boards in performance measurement and scenario planning but requires directors to understand its strengths and limitations. Independent directors may play a key role in overseeing data governance.

-

Legal and Oversight Implications: As AI becomes more prevalent, directors’ duties may evolve to include a baseline understanding of AI. The UK Corporate Governance Code and Companies Act 2006 mandate board oversight and risk management, which now extends to AI tools. Boards should acquire relevant AI knowledge to meet evolving legal standards.

-

Current Practices and Legislative Initiatives: EU and UK regulations aim to enhance shareholder engagement through better identification and participation in general meetings. Existing databases and communication methods already support this, but disparities in information disclosure persist. DLT can centralize and equalize information distribution.

- Future Developments and Ethical Considerations: While DLT and AI offer significant benefits, their implementation raises questions about decentralization costs, security (e.g., blockchain’s immutability claims), and policy implications. The roundtable discussions emphasized using these technologies as tools to improve governance systems rather than ultimate solutions.

-

Killer Acquisitions: Song Ma's study reveals that market incumbents in the pharmaceutical industry often acquire innovative targets to terminate their projects, especially when product overlaps exist. This practice, known as "killer acquisitions," is found to occur in about 7% of cases, potentially reducing the overall industry's drug project continuation rate by over 5%.

- Liquid Stock as Acquisition Currency: Johan Maharjan's research highlights the importance of stock liquidity in M&A transactions. Acquirers with more liquid stocks are more likely to succeed in acquisitions, offer lower premiums, and see increased announcement returns. This effect is confirmed through quasi-natural experiments using stock-market decimalization and the Russell-1000/2000 reconstitution.

-

Financial Protectionism and Shareholder Wealth: Darius Miller's paper examines the impact of the Foreign Investment and National Security Act of 2007 (FINSA) on M&A activity. The findings show that FINSA led to a 68% decline in foreign takeovers of affected firms, primarily in technology sectors, and resulted in a value loss of 1.12% to 2.15% for these firms.

-

Credit Control of Corporate Acquisitions: David Becher's study explores how creditor monitoring, particularly through covenant violations, affects acquisition decisions. Firms under creditor control due to covenant violations earn higher stock returns upon announcing acquisitions, suggesting that creditor governance can align managerial actions with shareholder interests.

- Mergers and Employee Job Search: Ashwini Agrawal's research uses job search data to show that employees increase job search activity months before an M&A announcement. This behavior indicates that employees may have prior knowledge of potential M&A activity, and those at target companies often seek lower wages in new jobs, reflecting job security concerns.

-

Short-termism as a Problem: The roundtable began by addressing whether short-termism is a significant issue. It concluded that there is substantial empirical evidence supporting the existence of short-termism, which is characterized by actions that improve short-term performance at the expense of long-term value, such as reducing spending on R&D or maintenance.

- Role of Loyalty Voting Shares: While loyalty voting shares are designed to encourage longer holding periods by granting additional voting rights to long-term shareholders, the consensus was that they primarily function as control enhancing mechanisms for controlling shareholders. They do not effectively promote long-term behavior among institutional or retail investors.

-

Regulatory Framework and Adoption: Loyalty voting shares are legally recognized in several countries, including the Netherlands, France, Italy, and soon Belgium. The rules for introducing these shares are generally more flexible than those for traditional dual-class structures. However, they are often introduced despite significant opposition from a majority of shareholders, primarily benefiting controlling shareholders.

-

Empirical Evidence and Practical Use: Empirical evidence from France and Italy shows a significant demand for loyalty voting shares. However, these shares are almost exclusively used by controlling shareholders and do not lead to increased holding periods. Instead, they serve as mechanisms for maintaining control, particularly in family firms and state-owned enterprises trying to unwind equity stakes.

- Debate on Desirability and Future Discussions: The roundtable highlighted a need for further debate on the desirability of control enhancing mechanisms like loyalty shares. While some participants argued for prohibiting such mechanisms or subjecting them to sunset provisions, others believed this should be left to market forces. The roundtable concluded with the announcement of a second meeting to continue these discussions.

-

Managerial Labor Markets and Gender Discrimination: The colloquium discussed the role of managerial labor markets in mutual and hedge funds, highlighting gender disparities. Renée Adams' research indicated that female managers are more likely to exit the industry following mutual fund closures due to attributional rationalization, where employers disproportionately blame women for unsuccessful teamwork.

- Career Risk in Asset Management: Marco Pagano's paper emphasized that asset managers face significant career risks. Poor performance leading to fund liquidation results in substantial drops in job level and compensation, particularly for top employees. This suggests that labor market discipline complements firm-level incentives.

-

Corporate Governance in Emerging Markets: Research presented by Bernard Black and Pablo Slutzky focused on corporate governance in emerging markets. Black's study showed that country-specific corporate governance indices are more effective than broad indices, while Slutzky's research highlighted the flexibility of private companies in complying with regulations, which impacts M&A patterns in emerging markets.

-

Index Funds and Corporate Behavior: Charles Wang's study found that firms close to being included in prestigious indices, like Japan's JPX400, tend to improve their return on equity, suggesting that firms respond to symbolic incentives. Additionally, concerns were raised about the implications of common ownership on acquisitions, executive pay, and governance.

- Dual-Class Structures and Shareholder Voting Rights: A significant discussion revolved around the role of index providers in corporate governance, especially following Snap Inc.'s IPO, which offered non-voting stock to the public. The debate underscored the need for legislative and regulatory decisions on dual-class structures, as well as the potential influence of index providers on corporate governance standards.

-

Common Ownership Panel Discussion: The focus panel titled "Common Ownership: Antitrust Meets Corporate Governance" discussed the challenges faced by asset managers holding significant stakes in multiple companies within the same industry. The panel highlighted the tension between increased stewardship and governance involvement versus the potential for collusion between competing firms with the same shareholders.

- Debate on Foreign Takeovers: An Oxford Union-style debate tackled the motion "This House believes that Brussels should have the power to block foreign takeovers." Levin Holle and Peter Montagnon proposed the motion, opposed by Professors John C. Coffee and Ernst-Ludwig von Thadden. After a lively debate, the motion was narrowly defeated.

-

Keynote Speech by Dr. Eckhard Cordes: During the ECGI Members’ dinner, Dr. Eckhard Cordes delivered a keynote speech, sharing his experiences from serving on thirteen boards across various countries, providing valuable insights into corporate governance from his extensive career.

-

Annual Lecture by Professor Antoinette Schoar: Professor Schoar presented new research on the use of personal data by financial intermediaries in the U.S. to market pre-approved credit cards. Her lecture, "Is Big Data a Challenge for Boards?", raised moral dilemmas regarding the selective selling of more expensive products to less educated customers by shrouding actual terms within marketing material.

- Research Prizes Awarded: The meeting concluded with the awarding of two research prizes. The Finance Series prize went to Professors Mike Burkart, Salvatore Miglietta, and Charlotte Ostergaard for their paper on "Why Do Boards Exist? Governance Design in the Absence of Corporate Law." The Law Series prize was awarded to Professor John C. Coffee for his paper "The Agency Costs of Activism: Information Leakage, Thwarted Majorities, and the Public Morality," addressing the agency costs specific to hedge fund activism.

-

Reevaluating AI's Role in Professions: Richard Susskind emphasizes the need to rethink the impact of Artificial Intelligence on professions and corporations by focusing on desired outcomes rather than on whether AI will replace human tasks. He suggests that the social and economic roles of corporations can be enhanced through AI.

- Four Key AI Areas: Susskind identifies four influential areas of AI: question-answering systems, predictive systems, robotics, and emotion-detecting systems. He uses the examples of AI in courtrooms for resolving low-value disputes and in boardrooms for making investment decisions to illustrate AI's potential.

-

Judgement and Discretion: The discussion touches on whether AI can exercise judgement and discretion. Susskind argues that AI can handle uncertainty by processing vast amounts of data, potentially offering better solutions than human judgement.

-

Narrow vs. General AI: Susskind differentiates between narrow AI, which solves specific problems, and general AI, which possesses human-like intelligence. He notes the concern over general AI's potential to self-improve and highlights the need for multidisciplinary input from philosophers, economists, lawyers, and sociologists.

- Policy Recommendations: For the European Commission, Susskind suggests focusing on developing systems that replace human workers and revising educational curricula to produce graduates with skills relevant to the 21st century, rather than those suited to tasks already better performed by machines.

2017

-

Allocation of Corporate Power: The conference discussed the allocation of corporate power between shareholders and managers. It was noted that historically, the variation in power distribution has diminished. Institutional investors have played a significant role in reducing this variation, as seen in the UK where dual-class shares disappeared due to investor pressure.

- Voice and Exit Strategies: Institutional investors use both voice (engagement with management) and exit (selling shares) strategies to influence corporate governance. The relationship between these strategies is complex, and decisions to exit are not always a response to ineffective voice but can be influenced by various factors including poor company performance.

-

Impact of Court Decisions on Political Activism: The effect of a 2010 court decision lifting bans on corporate political advocacy was examined. The study found that firms with public pension fund holdings experienced negative returns post-decision, indicating that these funds prefer traditional forms of political activism. The study also highlighted the role of institutional investors in maintaining political connections.

-

Institutional Investors and Freeze-out Tender Offers: The impact of institutional investors on freeze-out tender offers in Israel was analyzed. It was found that higher institutional holdings increase the likelihood of offer rejections and that institutional investors can secure better premiums for shareholders.

- Short-term vs. Long-term Investors: The benefits of short-horizon investors were discussed, showing that firms with more short-term institutional investors respond more rapidly to market changes, such as import tariff reductions, leading to better performance through increased advertising, product differentiation, M&As, and executive turnover.

-

Institutional Share Ownership in India: India has a significantly lower level of institutional share-ownership compared to other major economies, with only 19% for the 100 largest listed firms, compared to 73% in the US and around 66% in the UK. This disparity is attributed to the unique profile of Indian share-ownership, where promoters hold about 48% of listed shares and government entities like the Life Insurance Corporation of India own an additional 5%.

- Impact of Foreign Institutional Investors: Higher levels of foreign institutional share-ownership tend to increase the value of companies and promote better corporate governance. Foreign investors are more independent in their views on sensitive corporate governance issues and are associated with higher long-term investment, employment, and innovation outputs in investee companies.

-

Regulatory Environment: Since 1992, Indian regulations related to foreign institutional ownership have progressively relaxed, making the definitions for different categories of foreign investors more liberal. Despite concerns about the short-term focus of foreign investors, there has been no significant leakage of foreign investment capital at a macro level.

-

Proxy Advisory Firms: Proxy advisors play a critical role in supporting institutional investors with large, geographically diverse portfolios. However, there are concerns about "lazy stewardship," where investors might follow proxy recommendations without due consideration. Indian proxy advisory firms are noted for their better understanding of local customs and practices compared to their global counterparts.

- Corporate Governance Engagement: There has been significant improvement in corporate governance awareness and practices in India since the allowance of foreign institutional investors. However, challenges remain, such as engagement on executive pay and the influence of family-run businesses. The role of media and upcoming regulations like an All-India Stewardship Code are expected to further enhance corporate governance standards.

-

Diverse Approaches to BLER: The roundtable highlighted that BLER is implemented differently across Europe, with some countries mandating it while others adopt it voluntarily. The discussion included practical examples from the UK and Denmark, demonstrating the varied implementation and impact of BLER.

- Theoretical Foundations: Franklin Allen provided an overview of the theory behind employee involvement in corporate governance. He explored the separation between ownership and control, stakeholder governance, and the cultural differences influencing corporate purposes. He emphasized the gap between academic theories and real-world corporate scandals, prompting debates on the practicalities of governance models.

-

Institutional Variability: Lionel Fulton presented the institutional facts about BLER across the European Economic Area, noting significant country-specific differences in legislative frameworks. He discussed the variations in the number of employee representatives, the types of boards, and the thresholds for implementing BLER, highlighting ongoing regulatory changes and the heterogeneity in European BLER laws.

-

European Company (SE) Model: Horst Eidenmüller discussed the impact of the European Company (SE) model on BLER, noting that companies often reincorporate as SEs to mitigate or avoid BLER. He recommended more flexibility and freedom of contract in BLER regimes rather than a one-size-fits-all European mandate, allowing companies to experiment with different governance models.

- Empirical Challenges and Impact: Ernst Maug addressed the empirical challenges in assessing BLER's impact on corporate behavior and performance. He concluded that empirical studies are inconclusive and that firms’ behaviors suggest no significant gains or losses from BLER. This highlighted the complexity of measuring BLER's impact due to various interacting dimensions of corporate governance.

-

Study Overview: The research, funded by the Norwegian Finance Initiative and conducted by professors from Solvay Brussels School, London Business School, and Bocconi University, focuses on Standard Life Investments' active ownership practices from 2003 to 2015. It examines how the asset manager uses governance and stewardship to influence its portfolio companies.

- Governance Health Warnings: Standard Life Investments employs Governance Health Warnings to signal companies that require intense engagement. These warnings impact investment decisions and encourage companies to improve governance practices.

-

Panel Discussion Insights: The panel, including experts from academia and industry, discussed the decline in the number of listed companies and the shift in how companies are valued, emphasizing the importance of governance and long-term relationships between asset managers and companies.

-

Investor Loyalty and Engagement: The report highlights the necessity for asset managers to maintain loyalty and long-term perspectives. The importance of engaging with companies to influence positive outcomes and support long-term strategies was stressed.

- Challenges and Future Directions: The panel addressed challenges such as short-termism, compensation focus, and the impact of passive funds. The need for improved regulation, better succession planning, and a holistic approach to governance and investment was underscored to restore trust in business and financial institutions.

-

Impact of M&A on Financial Constraints: Jie Yang's research demonstrated that financially constrained firms alleviate their constraints through acquisitions, especially via diversifying acquisitions. These firms raise more debt and increase investments post-acquisition, showing significant announcement returns.

- Role of Bilateral Investment Treaties (BITs): Brandon Julio’s study found that BITs increase the volume and likelihood of cross-border mergers, particularly benefiting smaller and politically moderate-risk countries. This underscores BITs’ role in facilitating capital flows from developed to developing nations, enhancing target firms' merger announcement returns.

-

Trade and Merger Waves: Eric de Bodt’s analysis revealed a positive correlation between trade networks and M&A activity, where strong trade links amplify merger waves. The study highlighted that trade flows drive M&A activities, and significant global trade events influence this dynamic.

-

Political Influence on Antitrust Reviews: Mihir N. Mehta’s paper discussed how political connections impact antitrust reviews. M&A parties in constituencies of judiciary committee members often experience more favorable and expedited reviews, driven by lobbying and business connections rather than voter job loss concerns.

- Future of M&A Activity: Michel Driessen’s keynote address emphasized geopolitical instability, protectionism, and digital revolution as key factors influencing future M&A activities. While private equity firms remain active, megadeals have declined. He highlighted the shift towards digital innovation, which is changing business strategies and expanding deal types beyond traditional acquisitions.

-

Institutional Investors and Corporate Governance: The report highlights the significant increase in institutional ownership from around 10% in the 1950s to about 70% in the early 2000s. Amil Dasgupta emphasizes the evolution of corporate governance literature, focusing on how institutional investors have become key players in monitoring and influencing firm behaviors through sophisticated trading strategies and multi-layered agency relationships.

- Impact of Common Ownership: Martin Schmalz's presentation discusses the adverse effects of common ownership on competition and CEO incentives. The findings suggest that institutional investors holding stakes in multiple firms within the same industry may reduce competitive incentives, leading to less aggressive managerial compensation structures and potentially diminishing overall firm performance.

-

Wolf Pack Activism: Richmond Mathews introduces a model exploring how small blockholders can collectively exert influence despite their individual limitations. The concept of "wolf pack activism" illustrates how reputational concerns and strategic complementarities among fund managers enable coordinated efforts to engage with target firms, enhancing collective influence.

-

Venture Capital and Capital Allocation: Giorgia Piacentino's paper analyzes how venture capitalists' career concerns impact their investment decisions and market outcomes. The study finds that career-concerned VCs tend to be more conservative, rejecting high-quality startups. However, this conservatism can lead to more reliable signals in the market, reducing information asymmetry and lowering IPO underpricing.

- Influence of Public Opinion on Investor Voting: Laura Starks examines the interplay between media coverage, public opinion, and proxy advisors' recommendations. The study reveals that adverse media coverage positively impacts shareholder support for proposals, particularly post-financial crisis. This suggests a growing independence of shareholders from management and proxy advisors, influenced directly by public sentiment.

-

Common Ownership and Executive Incentives: Mireia Giné presented findings on how common ownership by the same investors across firms leads to executives being incentivized based on the performance of rival firms rather than their own. This challenges traditional views on firm objectives and compensation strategies.

- Cultural Influence on Director Decisions: Amir Licht discussed how individual and institutional values and culture impact board members' decision-making globally. This highlights the complex interplay between cultural context and corporate governance practices.

-

Impact of Short-Term Investors: Mariassunta Giannetti showed that firms with short-term institutional investors performed better in the long run after experiencing significant negative shocks, compared to firms without such investors. This underscores the potential benefits of short-term investment perspectives during periods of radical change.

-

State-Owned Enterprises and Environmental Engagement: Pedro Matos' research indicated that government-controlled companies are more engaged in environmental issues without compromising shareholder value. This points to the potential positive role of state ownership in promoting corporate environmental responsibility.

- Stewardship Code in Japan: The panel discussed the introduction and revision of Japan's Stewardship Code. Key points included the specific challenges and advantages of implementing stewardship practices in Japan, especially given the unique role of the Government Pension Investment Fund (GPIF) as a significant institutional investor.

-

Equity Markets and Entrepreneurial Finance: The limited role of capital market financing in the EU is attributed to cross-border obstacles and regulatory burdens on smaller firms. While reducing these burdens might spur innovation and job creation, it risks hurting investors due to information asymmetries. Regulation remains necessary to counter adverse selection problems, with a focus on revising cost-adding questions for smaller issuers. Crowdfunding is seen as a viable alternative, despite concerns about investor protection.

- Debt Markets and Securitisation: Post-crisis regulatory reforms aimed at increasing 'skin-in-the-game' for securitisations have not fully aligned incentives between originators and investors. A new risk-retention metric was proposed to enhance transparency. Additionally, the European Commission's focus on preventive corporate restructuring frameworks aims to facilitate capital movement and business establishment but faces criticism for potentially raising financing costs and sheltering failing firms.

-

Regulating Financial Innovation: The rise of shadow payment systems, including cryptocurrency exchanges and peer-to-peer platforms, presents regulatory challenges. These systems operate outside traditional banking regulations and lack central bank support, posing risks of illiquidity and loss of value for customers. Various strategies to mitigate these risks were assessed but found wanting, underscoring the need for legal and regulatory frameworks to ensure stability and liquidity.

-

Institutional Design and Implementation: Harmonizing conditions across fragmented EU markets presents challenges. Studies on the Market Abuse Directive and Transparency Directive showed increased market liquidity but highlighted disparities in regulatory quality across countries. Effective regulatory harmonization may require coordinated institutional changes, which are politically complex to achieve. A holistic approach to investor protection, incorporating information, conduct of business rules, and product regulation, is essential.

- Brexit and Capital Markets Union (CMU): Brexit's impact on European financial markets remains uncertain, with differing views on its significance. While some argue it will not substantially alter financial integration, others highlight misalignments and underestimated stakes. Brexit creates opportunities for institutional reform within the CMU, including empowering the European Securities and Markets Authority (ESMA) to enhance market oversight and regulatory consistency across the EU

2011

-

Shareholder Engagement and Short-termism: The report emphasizes the need to incentivize institutional investors for long-term engagement. It discusses issues such as the lack of shareholder engagement, the potential benefits of shareholder activism, and the challenges posed by short-term investment behaviors. More empirical research is needed to understand the dynamics of shareholder engagement and the impact of short-termism on corporate governance.

- Boards and Directors: The discussion highlights the importance of board composition, diversity, and the evaluation of boards' effectiveness. It addresses the roles and responsibilities of directors, the need for regular external evaluations, and the potential benefits of separating the roles of CEO and Chairman. The effectiveness of gender quotas and the impact of board evaluations on decision-making are also explored.

-

Gatekeepers and Their Role: Gatekeepers such as auditors, analysts, proxy advisers, and credit rating agencies play a crucial role in corporate governance. The report points out the need to examine their effectiveness, potential conflicts of interest, and the implications of who pays for their services. It suggests that further analysis is required to understand the impact of gatekeepers on market stability and corporate governance.

-

Regulation vs. Soft Law: The balance between hard law and soft law in regulating corporate governance is debated. The report suggests that while regulation is necessary in some cases, especially in financial institutions, soft law or standards and practices might be more appropriate for non-financial institutions. The potential risks of over-regulation and the importance of flexibility in governance practices are highlighted.

- Research Opportunities: The report identifies several research areas, including the nature and effects of shareholder engagement, the impact of board composition and diversity, the effectiveness of gatekeepers, and the appropriate balance of regulation in corporate governance. It calls for empirical studies to provide evidence-based insights that can inform policy and improve corporate governance practices.

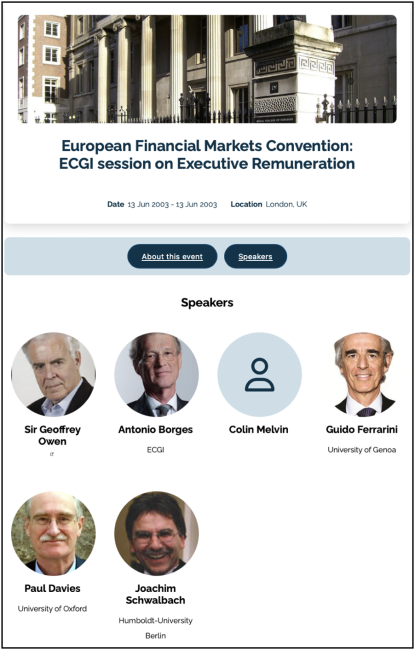

2003

-

Importance of Executive Remuneration: Executive remuneration is a critical issue in corporate governance, drawing significant public attention. Top management significantly influences company health and shareholder value, necessitating competitive compensation to attract and retain talent, while also ensuring mechanisms to remove underperforming executives.

- Challenges and Excesses: There is a general consensus that executive compensation has often exceeded sensible limits, with pay packages inflating drastically over the past decades. Problems include large payments to failing directors, complex remuneration reports designed to mislead shareholders, and performance targets that do not align with company prospects.

-

Best Practices and Recommendations: The International Corporate Governance Network (ICGN) has outlined best practices for remuneration, including independent remuneration committees, appropriate and transparent compensation structures, linking pay to performance, substantial stock ownership by executives, and avoiding payments for mere participation in mergers and acquisitions.

-

Disclosure and Regulation: Disclosure of executive remuneration varies across Europe, with some countries providing detailed, individualized information while others offer only aggregate data. Effective disclosure is essential for transparency and accountability, influencing shareholder decisions and aligning executive pay with performance.

- Institutional Investor Role: Institutional investors are encouraged to devote more resources to understanding and analyzing remuneration proposals. Active corporate governance, as practiced by firms like Hermes, supports long-term shareholder interests by influencing executive remuneration structures to be fair, transparent, and performance-linked.