The ECGI blog is kindly supported by

Rethinking Executive Pay Metrics and Shareholder Influence

A review of the lecture “Beyond ESG: Executive Pay Metrics and Shareholder Support” by Prof. Mariassunta Giannetti on 5th February 2025.

The integration of ESG factors into executive compensation has been a subject of increasing debate among investors, boards, and policymakers. While the inclusion of ESG-linked incentives in CEO pay packages is often seen as a step toward corporate accountability, research suggests that these metrics may serve a different function altogether. In a compelling lecture at the Kelley School of Business, Professor Mariassunta Giannetti (Stockholm School of Economics and ECGI) explored the intricate relationship between pay metrics, shareholder support, and corporate strategy—revealing that ESG incentives are often more about consensus-building than performance alignment.

In recent years, the rise of ESG-linked executive compensation has sparked both enthusiasm and skepticism. On one hand, these metrics are seen as a way to align CEO incentives with long-term sustainability goals. On the other, critics argue that ESG pay components may simply be an additional layer of corporate signaling rather than a genuine mechanism for influencing executive behavior.

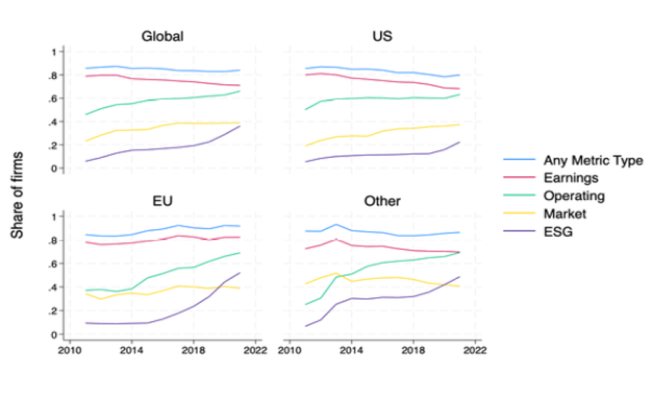

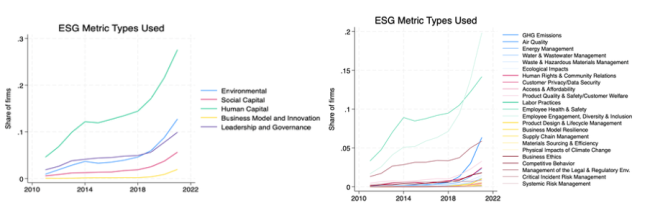

Giannetti’s research, co-authored with Nickolay Gantchev and Marcus Hober, examines how firms structure their CEO compensation contracts using market, earnings, operating, and ESG metrics. Using a comprehensive dataset, the study finds that while ESG pay metrics have increased, they are often introduced alongside an expansion of operating metrics, suggesting that companies are broadening their pay structures rather than shifting towards ESG priorities.

A key finding from the research is that firms that introduce ESG metrics tend to perform relatively well on those same dimensions prior to adoption. This contradicts the expectation that ESG incentives are implemented to drive improvements in areas where companies underperform. Instead, the evidence suggests that companies are more likely to introduce ESG targets after they have already demonstrated strong sustainability performance.

Moreover, the study finds little to no correlation between the introduction of ESG metrics and actual CEO pay outcomes. Unlike market, earnings, and operating metrics, which show a strong link to the level of CEO compensation, ESG targets have a statistically insignificant impact on total pay, stock options, and bonuses. Overall, the evidence mitigates concerns that ESG metrics are just a manifestation of CEO power in increasing pay levels but raises questions about whether ESG metrics truly serve as performance-based incentives.

If ESG metrics do not meaningfully impact CEO compensation, why do firms adopt them? The answer, according to Giannetti’s research, lies in shareholder relations rather than direct managerial incentives. Firms that include more detailed metrics—especially ESG-related ones—tend to experience greater shareholder consensus in say-on-pay votes.

The research finds that companies facing shareholder dissent over executive compensation are more likely to expand the number of disclosed pay metrics, including ESG goals. These metrics serve as an explanatory tool, helping firms justify pay decisions to investors and preemptively reduce opposition to CEO pay packages. This strategic use of ESG metrics suggests that they may be more about maintaining legitimacy and reducing conflict rather than reshaping executive behavior.

Furthermore, companies with a higher number of disclosed pay metrics receive fewer shareholder proposals on executive compensation and ESG issues. This indicates that expanded metric disclosure may serve as a corporate governance tool to align with investor expectations while mitigating shareholder activism.

Another significant revelation from the study is that companies with new activist blockholders—such as hedge funds and private equity investors—are more likely to introduce ESG metrics into compensation contracts. This suggests that ESG pay metrics serve as a tool for engaging with institutional investors, rather than being purely a driver of managerial incentives. In contrast, firms with large non-institutional blockholders (e.g., family-controlled businesses) are less likely to adopt ESG pay metrics, reinforcing the idea that institutional pressure plays a critical role in shaping these policies.

Interestingly, the study finds that ESG metrics are often introduced alongside an increasing reliance on operating metrics, particularly in firms that have experienced high market volatility, a recent CEO transition, or shareholder activism. This suggests that companies are expanding the scope of their pay structures as a broader governance strategy rather than prioritizing sustainability incentives.

Critics of ESG pay structures often argue that they enable CEO rent extraction, allowing executives to justify higher compensation under the pretense of ESG commitments. However, Giannetti’s research finds no clear evidence supporting this concern. CEOs in firms that use ESG pay metrics are not systematically overcompensated, and the presence of ESG metrics does not reduce the sensitivity of CEO pay to stock market performance. This suggests that, while ESG metrics may serve a governance function, they do not necessarily lead to excessive CEO pay inflation.

Giannetti’s lecture raised important questions about the evolving role of ESG in corporate governance. While ESG metrics in executive pay have become more prevalent, their impact on actual compensation remains unclear. Instead, their primary function appears to be one of shareholder engagement and expectation management rather than a performance-driven incentive structure.

Looking ahead, the growing ESG backlash in the U.S. is likely to shape how companies approach ESG pay metrics in the future. Political and regulatory pushback could lead to a slowdown in the adoption of ESG-linked incentives, particularly in industries where sustainability commitments face political scrutiny. Some firms may rebrand ESG-related metrics as broader “stakeholder”, “long-term value”, or “resilience” indicators to avoid controversy, while others may shift toward more financialized performance metrics to appease skeptical investors. Meanwhile, European firms—facing stricter ESG disclosure requirements—may continue expanding sustainability-linked pay structures, resulting in a divergence between U.S. and European corporate practices. For ESG pay to remain credible, it must evolve in response to these pressures, and if ESG pay metrics are to have a meaningful impact on corporate sustainability, they should move beyond their current role as a signaling mechanism and become a genuine driver of executive decision-making and corporate performance.

-----------------------------------

This lecture is part of the Indiana University - ECGI Online Series, a public lecture series on corporate governance. The Kelley School of Business Institute for Corporate Governance (ICG+E), in partnership with Ethical Systems, collaborates with ECGI to deliver this ongoing initiative. As part of this public lecture series, distinguished speakers share insights on the evolving landscape of governance, finance, and market regulation.

To download the presentation slides, click here.