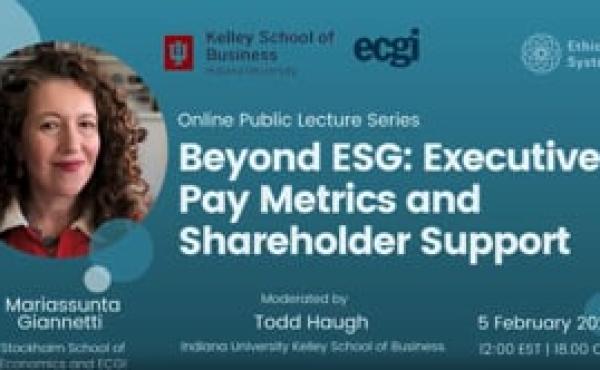

Finance Series

Beyond ESG: Executive Pay Metrics and Shareholder Support

Key Finding

Increase in ESG metrics has been accompanied by a higher propensity to use operating metrics

Abstract

We document that executive compensation contracts feature a multitude of market, earnings, operating, and ESG metrics and that the increase in ESG metrics has been accompanied by a higher propensity to use operating metrics. These developments are particularly pronounced in companies with volatile returns, recently appointed CEOs, and new active blockholders, such as activist hedge funds and private equity investors. Compensation metrics do not appear to have a large effect on actual payouts to executives and on the sensitivity of pay to market, earnings, and ESG performance, but rather aim to create consensus among shareholders on the proposed pay and the overall corporate strategy.