The ECGI blog is kindly supported by

“Glossy Green” Banks: The Disconnect Between Environmental Disclosures and Lending Activities

In the wake of the Paris Climate Agreement, banks are under increasing pressure to demonstrate their commitment to environmentally responsible practices. In response, many financial institutions are increasingly emphasizing their environmental disclosures to showcase their commitment to sustainability. However, there is growing skepticism about whether banks are strategically disclosing information to burnish their sustainability image while masking their true sustainability impact. That is, their disclosures and claims may be nothing more than “cheap talk.”

Do banks walk the talk?

This blog addresses an important question: do banks that put more emphasis on the sustainability of their lending policies engage in greener lending? Not so much, our research suggests. If the emphasis on the sustainability of the lending policies reflected actual lending decisions, we would expect that banks issue less credit to brown borrowers. An insignificant relation between the sustainability of the banks’ lending policies and green lending would instead indicate greenwashing.

However, our findings highlight a serious disconnect between what banks claim in their disclosures and the environmental impact of their lending decisions: Not only banks that portray themselves as more environmentally conscious do not have greener portfolios, but they make more brown loans. Banks thus appear to be strategically disclosing positive sustainability actions and withholding information about negative ones, casting doubt on the extent to which they can be active players in the green transition.

To reach this conclusion, we turn to the rapidly developing field of large language models (LLMs) for analyzing financial texts. Using ChatGPT, we examine annual and sustainability reports to see how banks discuss the sustainability of their lending policies. We combine textual analysis of these reports with granular data on banks’ lending from AnaCredit, the credit registry of the entire Euro area.

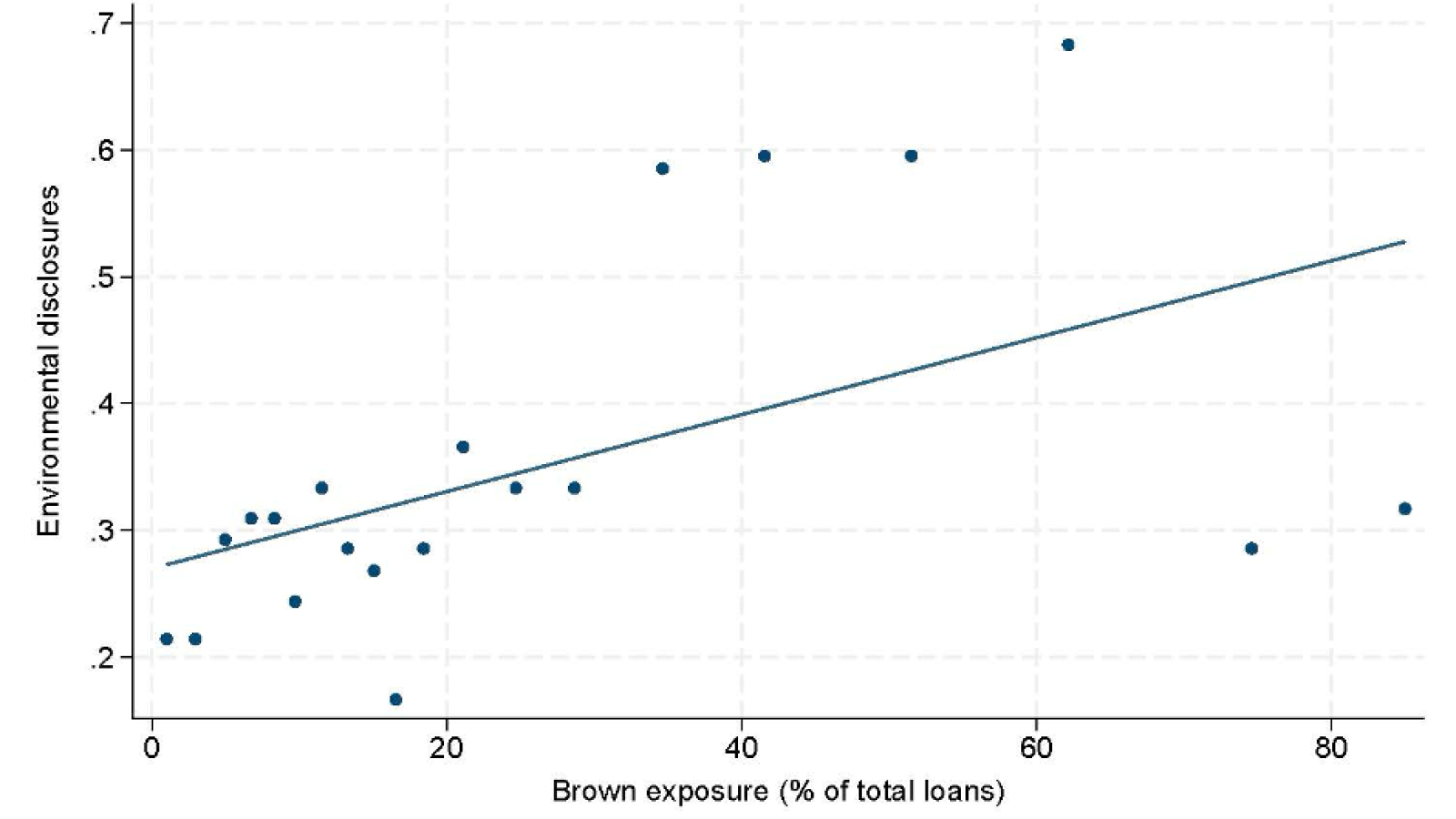

Our findings reveal a striking trend: banks with more extensive environmental disclosures tend to have better environmental ratings provided by external agencies but also a history of significant exposure to brown industries. As shown in Figure 1, the banks with more extensive environmental disclosures have large exposures to brown industries, which may indicate that banks have incentives to communicate about how their lending model is changing towards more green policies. But going forward do they actually engage in greener lending?

Figure 1. Banks’ Emphasis on the Sustainability of Lending Policies and Exposure to Brown Industries

Notes: The figure shows the bin scatter plot depicting the relationship between banks' Environmental Disclosures and their ex-ante exposure to brown borrowers. It displays a bin scatter plot for the lagged share of the bank's lending to brown borrowers as a proportion of total credit outstanding (Brown exposure) and the continuous variable bank's Environmental Disclosures. Both scatter plots present averages for the data sorted into 20 bins based the exposure to brown firms.

Green talk and brown loans

We find that banks that overemphasize the environment in their reports do not lend more to green firms. On the contrary, these banks are more likely to lend to brown firms. Banks that emphasize the sustainability of their lending policies in their disclosures end up increasing the share of loans they give to brown industries, while reducing that to green industries. Furthermore, these banks do not appear to use stricter terms or higher interest rates to discipline their brown borrowers.

These patterns are more pronounced for loans to small brown borrowers, which are hardly verifiable by market participants. Our results thus suggest that focusing on banks’ entire loan portfolios, i.e. going beyond the largest borrowers, such as those in the syndicated loan market or those with available carbon emission data, is crucial for assessing the environmental impact of banks’ lending decisions.

Are banks helping brown industries get greener?

We examine whether banks that portray themselves as environmentally conscious are more likely to support brown borrowers in their efforts to transition towards greener business models. We use several proxies to capture whether a firm is in its green transition phase, including borrowers’ age, capital expenditures or investments in R&D, or whether the borrower is signatory of the Science Based Target initiative. We find no evidence consistent with this argument.

Instead, we document that banks with high environmental reporting are particularly inclined to continue lending to brown zombie borrowers, i.e., financially underperforming firms with a negative carbon footprint. Banks seem to have incentives to hide their exposure to brown industries by keeping zombie polluters alive. Thus, banks’ strategic disclosures appear to be accentuated by their incentives to continue lending to financially unhealthy brown borrowers that are likely to have fewer financing alternatives. These are the borrowers that would experience distress if their bank relationships were severed, with potentially adverse effects on banks’ balance sheet.

Policymakers are increasingly recognizing that climate change poses a major and urgent threat to our economies. The green transition is essential, and banks could play a critical role in this transition. However, our findings show that banks currently lack incentives to report on their environmental policies in a way that truly reflects their lending practices. Greater transparency and standardization of sustainability disclosures would help bridge the gap we have highlighted.

Our results also have important policy implications, as we provide empirical evidence that banks offer inadequate and potentially misleading environmental disclosures. The recent adoption of the EU Sustainable Finance Disclosure Regulation (SFDR) has already enhanced transparency among asset managers. Introducing similar regulations in the banking sector could limit greenwashing and possibly drive a more genuine green transition.

_________________

By Mariassunta Giannetti (Stockholm School of Economics), Martina Jasova (Barnard College), Maria Loumioti (University of Texas at Dallas) and Caterina Mendicino (European Central Bank)

The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.