The ECGI blog is kindly supported by

Corporate governance and racial diversity in Brazilian public companies

Note: In this article, racial categories were adopted as used by the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística – IBGE) in the National Household Sample Survey (Pesquisa Nacional por Amostra de Domicílios - PNAD).

In recent decades, the theme of diversity has gained prominence in debates on corporate governance. Diversity was one of the Millennium Goals. As a result, it was included in the social aspect of the environmental, social, and governance (ESG) programs, and it has always been highlighted in human rights and business policies. However, there are very few studies profiling the racial diversity at the top levels of corporate governance of public companies anywhere in the world. This is a gap in the literature that, by itself, already presents a problem. Is there anything being hidden?

The results are shocking, but not at all surprising.

In a new study on Corporate Governance and Racial Diversity in Brazil: a Picture of Public Companies, I made an attempt to bridge this gap by investigating the racial diversity of Brazilian public companies’ boards of directors and chief executive officer (CEO) and chief financial officer (CFO) positions. The results are shocking, but not at all surprising. From a sample of 69 public companies that responded to the survey, no Black board member was identified and only 1.05% were Brown, and absolutely no Black or Brown CEO or CFO were reported.

One of the reasons why there are so few studies available regarding the racial diversity of board members and senior officers of public companies may be the lack of a requirement to make specific disclosures about those matters and, also, the lack of a methodology to obtain such information from other sources. I attempted to overcome those difficulties by comparing a sample of information provided voluntarily by companies to information gathered by independent research of public information. Despite the fact that the research was conducted in Brazil, the methodology may be replicated in other jurisdictions with potentially revealing results.

Between January and May 2021, I sent requests to all Brazilian public companies to fill a form with information about the racial profile of their members of the board of directors, CEO, and CFO. The purpose was to compare such data with the information of the last official surveys of the Brazilian population to verify the degree of racial diversity mismatch between society in general and the top levels of corporate governance in public companies.

I conducted an independent research reviewing public information of all individuals in the positions of board members, CEO and CFO of all 442 Brazilian public companies.

Of the 442 public companies registered with the Brazilian Securities Commission (Comissão de Valores Mobiliários - CVM), 69 responded to my survey, or 15.61% of the total amount. In order to confirm the robustness of the sample, I conducted an independent research reviewing public information of all individuals in the positions of board members, CEO and CFO of all 442 Brazilian public companies. I adopted the same methodology applied by Brazilian public universities to identify fraud in the affirmative action procedures, investigating the companies’ documents made available to the market through the Brazilian stock exchange (B3), CVM, and the companies’ websites and comparing such information to data made available by the individuals in social networks and personal websites. In this independent research, we verified the information of individuals occupying a total of 3,561 positions, among which 449 were CEOs, 407 were CFOs, and 2,705 were effective members of the board of directors.

Of the 69 public companies that responded to the survey, I identified 727 confirmed positions as board members, CEO or CFO. From all individuals occupying such positions, 712 were identified by the companies as White people (pessoas brancas), 9 were identified as Asians (pessoas amarelas), 6 as Brown people (pessoas pardas), and 0 as Black people (pessoas pretas). The comparison of such results regarding the sample and the results of the independent research demonstrated that the results of the sample are statistically robust, meaning that the sample represents the actual condition of Brazilian public companies with minor potential variations. Those racial categories, despite some imprecision, particularly when translated into other languages, were adopted because they are the categories used by the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística – IBGE) in the National Household Sample Survey (Pesquisa Nacional por Amostra de Domicílios - PNAD).

Findings indicate that the chance of a White person occupying a senior management position in a public company registered at CVM is almost 58 times greater compared to a non-White person.

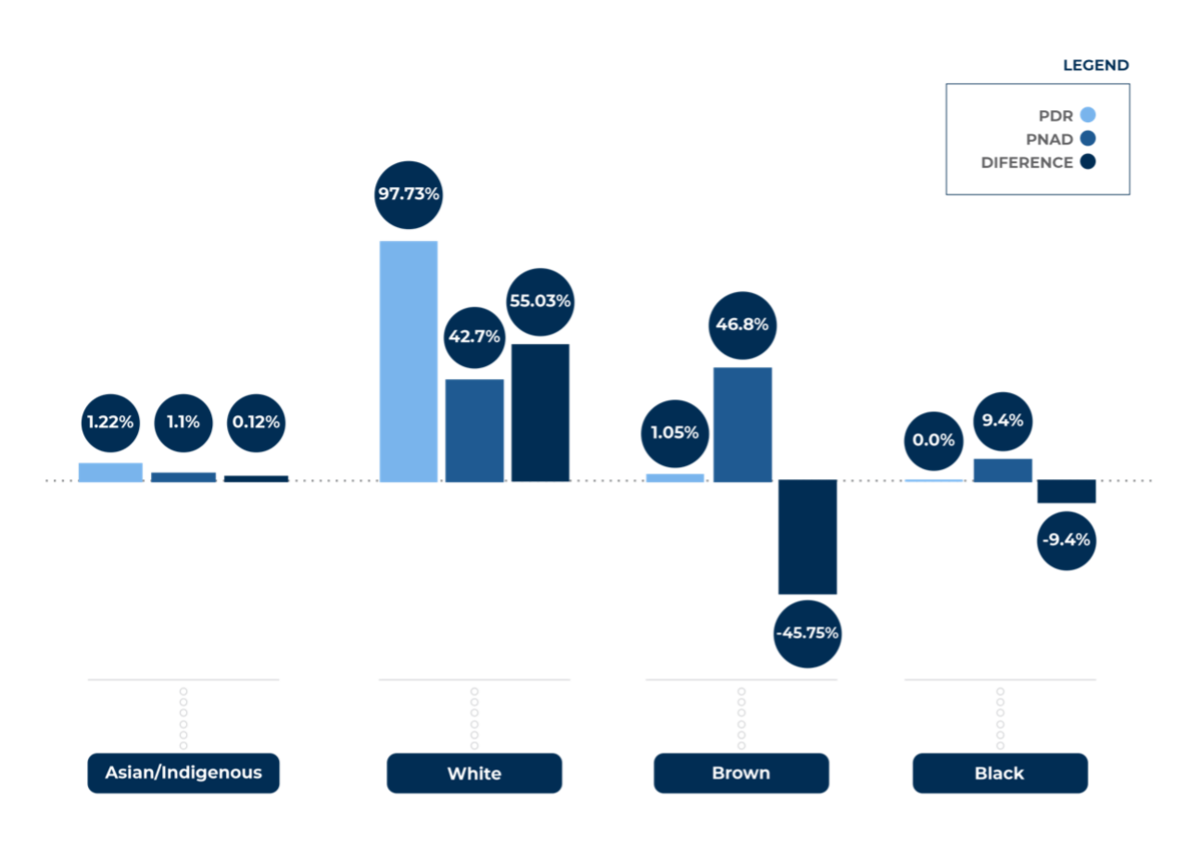

These results were then compared with data from the 2019 National Household Sample Survey (Pesquisa Nacional por Amostra de Domicílios - PNAD) to identify the difference between the profile of the senior management of the Brazilian public companies and the general population. My findings indicate that the chance of a White person occupying a senior management position in a public company registered at CVM is almost 58 times greater compared to a non-White person. As shown in the Figure 1 below, the survey identified that 0.00% of the positions on the boards of directors surveyed were held by Black people and that only 1.05% of them were held by Brown people.

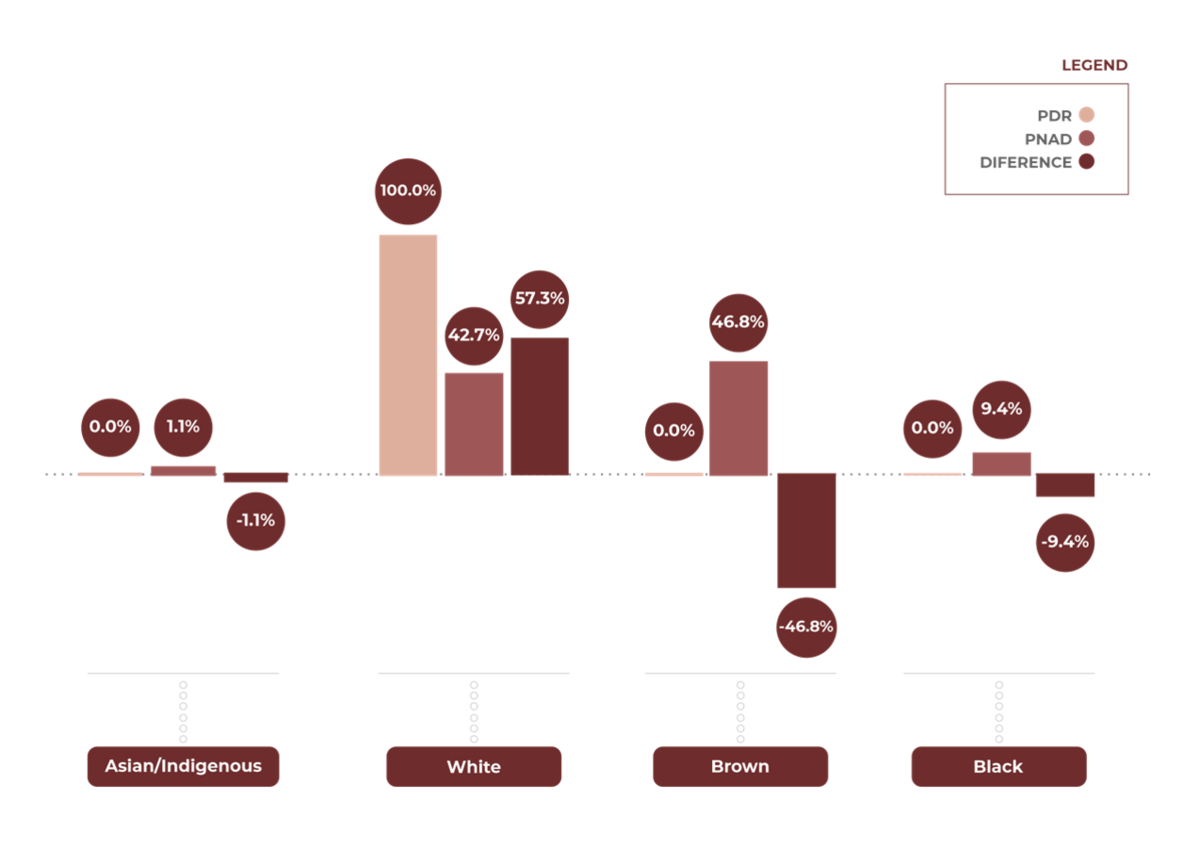

The results regarding the positions of CEO and CFO were even more impressive, since no Black or Brown people were identified in such positions. In the case of CEOs, my study shows a difference in favor of White people of 57.3% comparing the percentage of White CEOs in the sample (100%) and the total number of White people in PNAD (42,7%). In the case of Black people, the sample provided for a disadvantageous difference of 46.8%, since the CEO positions are held exclusively by White people, as Figure 2 below demonstrates.

In other words, the highest paying occupations in Brazil are closed to Black people, laying the foundations for a caste-based society.

These findings are particularly disturbing considering that the top management positions of Brazilian public companies are the ones with the highest compensation in the country. In other words, the highest paying occupations in Brazil are closed to Black people, laying the foundations for a caste-based society. Although such conclusions are based on research carried out only with Brazilian public companies, it is possible to assume that such disparities may also be identified in private companies in Brazil and public and private companies around the world in countries with racial diversity. Considering the expansion of inequality within countries in different societies in recent decades, coupled with the resurgence of racism around the world due to multiple factors, the process that I identified in Brazilian society might be replicated in other societies.

These results confirmed the hypothesis of the research project that the corporate governance of Brazilian public companies reinforces certain aspects of Brazil’s social structure, deeply marked by patriarchal and racist traits. Such structure conflicts with contemporary demands for companies to take an active role in social transformation beyond their contribution to the economic activity in which they are specialized. Such a demand goes further than the mere regulation of negative externalities, corporate social responsibility or philanthropy. The rise of ESG and business and human rights methodologies places corporate ethics as the main issue of corporate governance in the 21st century, requiring an empathic behavior from companies. Such demands may be particularly difficult to cope with in societies characterized by economic inequality and racial discrimination such as Brazil.

One important question to ask is whether it is possible to promote responsible capitalism in Brazil without providing for affirmative actions with a racial and/or gender component.

Given the alarming results identified by my research, one important question to ask is whether it is possible to promote responsible capitalism in Brazil without providing for affirmative actions with a racial and/or gender component. Considering Brazil’s historical issues with slavery, racism, and patriarchalism, I understand that there is a need for legislative, regulatory, self-regulatory, or voluntary changes by Brazilian public companies to create affirmative actions to increase diversity in the top corporate governance positions. Such changes may increase the prospects of Brazilian companies participating in the global economy and also become an important remedy to overcome structural racism in Brazilian society. Finally, I hope that this study can inspire further research in partnership with scholars from other jurisdictions in order to apply the same methodology and create an international database on the subject.

--------------------------------------------------

Carlos Portugal Gouvêa is a Professor of Law at the University of São Paulo in the Commercial Law Department and a Visiting Professor at Harvard Law School. His research topics focus on ESG and Business and Human Rights. Carlos is also a founding partner of PGLaw.

This article is from Issue 10 of the ECGI Blog, which features global perspectives on the issue of diversity, including articles from Laura Casares Field and the European Company Law Experts Group.

This article reflects solely the views and opinions of the author(s). The ECGI does not, consistent with its constitutional purpose, have a view or opinion. If you wish to respond to this article, you can submit a blog article or 'letter to the editor' by clicking here.