The ECGI blog is kindly supported by

Gender disclosure rules can make a difference

A corporate governance issue that has drawn broad attention is the underrepresentation of females on corporate boards. Many attempts to address this issue follow a rules-based approach, in which mandated quotas for female representation in boards are imposed. An alternative to a prescriptive regulatory approach is a principles-based one, under which firms publicly disclose their compliance with suggested “best practice” guidelines, and, if their practices depart from the guidelines, firms must explain the reasons for their non-compliance. Canada enacted such an approach in 2014, when the Ontario Securities Commission (OSC) introduced female representation policy disclosure requirements, which came into effect in December 2014, requiring listed firms to disclose policies regarding the representation of females on the board and in the executive suite, or to provide an explanation for their absence. In a new working paper, my coauthors and I examine the effects of this regulation.

First, we examine the market’s response to the regulation’s announcement. Notably, these results are in stark contrast to the negative returns observed for California’s SB 826 law mandating gender diversity for firms headquartered there. For the mandatory regulation in California, announcement returns were more negative for firms for which the quotas are more binding (e.g., those without female directors) – which is precisely the firms for which we observe significantly positive returns. To gain insights into the positive market reaction, we next examine the impact of the OSC regulation on the composition of Canadian boards around its passage.

The OSC regulation is associated with an increase in female director representation between 30-37%

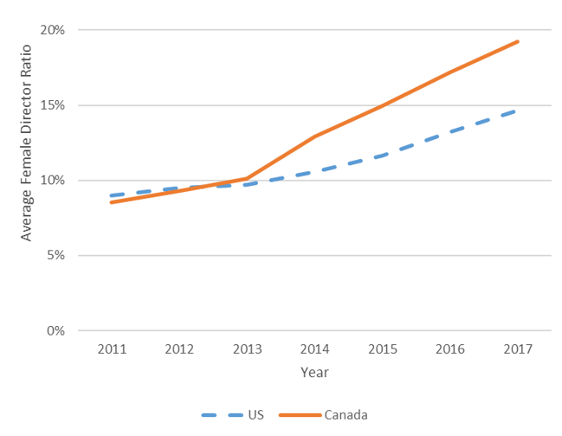

Although the regulation does not require firms to increase board diversity — it merely requires firms to disclose policies regarding female representation — we observe significant increases in female board representation following the regulation. The figure below plots the trajectory of the annual average fraction of female directors for both Canadian firms and their U.S. matches, based on total assets and industry. Although both groups have a similar proportion of females on their boards before the regulation, we see an upward trajectory for Canadian post-regulation, such that Canadian firms have significantly more female directors than their U.S. counterparts by 2017. Estimates from difference-in-differences regressions imply that, relative to a matched sample of U.S. firms, the OSC regulation is associated with an increase in female director representation between 30-37%.

Comparison of Canadian S&P TSX and U.S. Matched Firms

Next, we examine cross-sectional differences in gender diversity policies following the OSC’s amendment and find evidence suggesting that firms optimally choose to comply or explain based on the presence of economic frictions:

- Firms headquartered in provinces with a higher fraction of female directors are more likely to consider gender diversity when nominating directors.

- The number of connections with female directors in other firms and with firms that include target female director quotas is positively associated with the inclusion of a quota.

- Firms that do not implement female director target quotas, have directors that have fewer connections with female directors and are located in provinces with a lower fraction of female directors are more likely to indicate that they nominate directors based solely on skills, experience and/or merit, rather than using gender as a factor in the nomination decision.

Firms in provinces with a high female director ratio and with more connections to other firms with a targeted number of female directors employ friendlier language in their proxy statements towards gender diversity.

Interestingly, supply frictions are also associated with the use of friendlier gender diversity language. Using statements in the proxy statement related to board gender diversity, we construct an index that measures firm sentiment towards gender diversity. We find that firms in provinces with a high female director ratio and with more connections to other firms with a targeted number of female directors employ friendlier language in their proxy statements towards gender diversity.

Overall, our results suggest that a principles-based approach potentially mitigates some of the costs of complying with rules-based approaches, while still achieving the same broad objective — in this case, increased female representation in boards. A major critique sometimes made against principles based regulation is that the flexibility afforded to firms means that not all firms will choose to comply, which may result in a level of compliance that is socially suboptimal. Nonetheless, we find that 94% of firms in our sample had female directors on their boards by 2018, compared with only 56% before the OSC announcement. Moreover, the ratio of female directors in Canada has increased significantly more than for similar U.S. firms during the same period.

Our results demonstrate that a principles-based, “comply or explain”, regulation such as that put forward in 2014 by the OSC can have the desired effect of increasing board diversity.

Our results provide policy implications for regulators. Whether a rules-based approach, such as the one implemented in California, or a principles-based approach, such as the OSC’s amendment we study or Nasdaq’s recent proposal to improve board diversity, is best, depends on the regulator’s objective. If the objective is to increase board diversity at any cost, certainly a mandate will achieve the objective. However, prescriptive mandates may not be appropriate for all, as the costs of compliance may be prohibitively high for some firms. Moreover, given the recent summary judgment regarding the unconstitutionality of California’s AB 979, a principles-based approach such as that proposed by Nasdaq may be the only viable alternative for the U.S. Our results demonstrate that a principles-based, “comply or explain”, regulation such as that put forward in 2014 by the OSC can have the desired effect of increasing board diversity, while giving firms the opportunity to choose the optimal outcome for them, particularly when the cost of compliance is high.