Centre for Economic Policy Research (CEPR)

European Corporate Governance Institute (ECGI)

The Hebrew University of Jersualem

London Business School

Bar-Ilan University

Institutional Investor Activism and Engagement

** Click here to access the event summary report **

Jointly organized by

Centre for Economic Policy Research (CEPR)

European Corporate Governance Institute (ECGI)

The School of Business Administration, the Hebrew University Jerusalem

London Business School Center for Corporate Governance

Raymond Ackerman Family Chair in Israeli Corporate Governance, Bar-Ilan University

Organizing Committee

Marco Becht, Solvay Brussels School, ECGI and CEPR

Julian Franks, London Business School, ECGI and CEPR

Assaf Hamdani, Hebrew University of Jerusalem and ECGI

Beni Lauterbach, Bar-Ilan University and ECGI

Hannes Wagner, Bocconi University, Milan

Yishay Yafeh, Hebrew University, ECGI and CEPR

Confirmed Participants

Ian Appel, Boston College

Alon Brav, Duke University and ECGI

Jill Fisch, University of Pennsylvania and ECGI

Slava Fos, Boston College

Mariassunta Giannetti, Stockholm School of Economics and ECGI

Thomas Hellmann, University of Oxford

Cliff Holderness, Boston College

Robert Jackson, Columbia Law School

Doron Levitt, Wharton

Jörg Rocholl, ESMT Berlin and ECGI

Russ Wermers, University of Maryland

Bernie Black, Northwestern University and ECGI

Andrew Ellul, Indiana University and ECGI

Yaniv Grinstein, Cornell University and ECGI

Assaf Hamdani, Hebrew University of Jerusalem and ECGI

Ehud Kamar, Tel Aviv University and ECGI

Eugene Kandel, Hebrew University of Jerusalem and ECGI

Amir Licht, Interdisciplinary Center Herzliya and ECGI

Miriam Schwartz Ziv, Michigan State University

Michael Weisbach, Ohio State University

With financial support from

European Corporate Governance Research Foundation (ECGRF)

Norwegian Finance Initiative (NFI)

Raymond Ackerman Family Chair in Israeli Corporate Governance

The Center for Empirical Studies of Decision Making and the Law at the Hebrew University

The I-Core Program of the Planning and Budgeting Committee and the Israel Science Foundation, Grant no. 1821/12

This conference is supported by:

Programme

Registration and Coffee

Greetings

Session 1

Coffee

Session 2

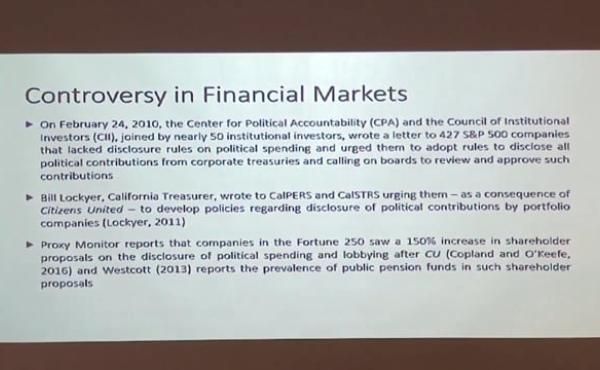

Public Pension Funds and Corporate Political Activism

Speaker(s)

Discussant

Lunch

Session 3

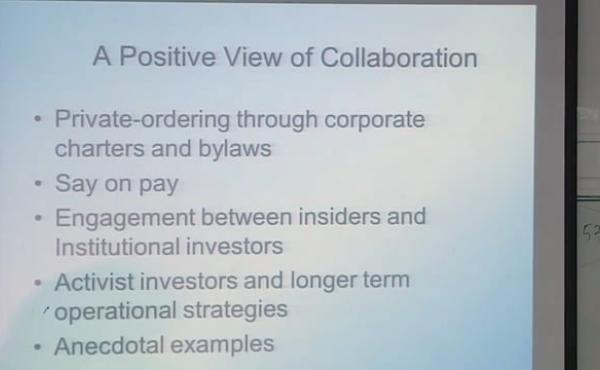

A Collaborative Model of the Corporation

Speaker(s)

Discussant

Coffee

Session 4

Soft Shareholder Activism

Speaker(s)

Discussant

Dinner

Session 1

Activist Directors and Information Leakage

Speaker(s)

Discussant

Activism, Strategic Trading, and Liquidity

Speaker(s)

Discussant

Coffee

Session 2

How Does Hedge Fund Activism Reshape Corporate Innovation?

Speaker(s)

Discussant

Job Creation: The Role of Foreign Venture Capital

Speaker(s)

Discussant

Lunch

Session 3

Coffee

Session 4

Dinner

Speakers

Jill Fisch

Vyacheslav Fos

Thomas Hellmann

Marco Becht

Beni Lauterbach

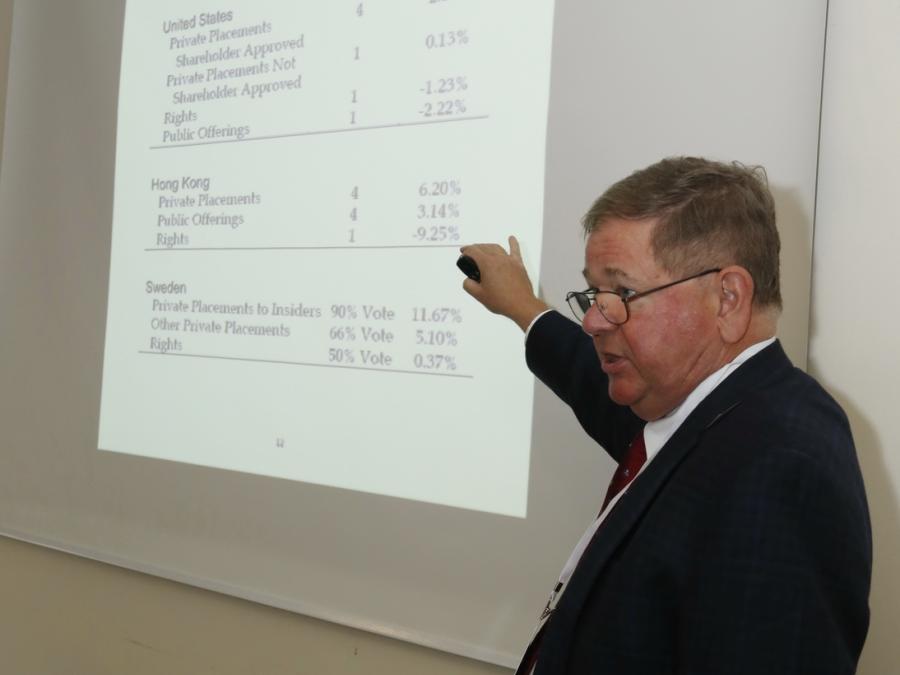

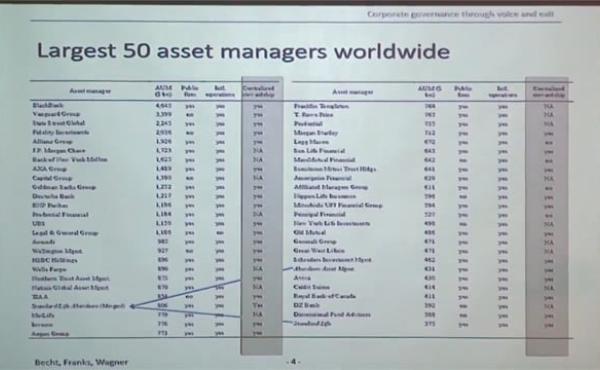

Presentations

Gallery

Contact