Global Corporate Governance Colloquia (GCGC) 2019

Click here to visit the Global Corporate Governance Colloquia (GCGC) website

Click here to download the programme (long version here).

*** This event was strictly by invitation only ***

The fifth annual GCGC Conference was hosted by the Research Center SAFE (Sustainable Architecture for Finance in Europe) at the House of Finance, Goethe University Frankfurt on 7– 8 June 2019.

GCGC 2019, hosted by Frankfurt University, provided a compelling blend of research exploring modern challenges in corporate governance with both academic rigor and practical insights.

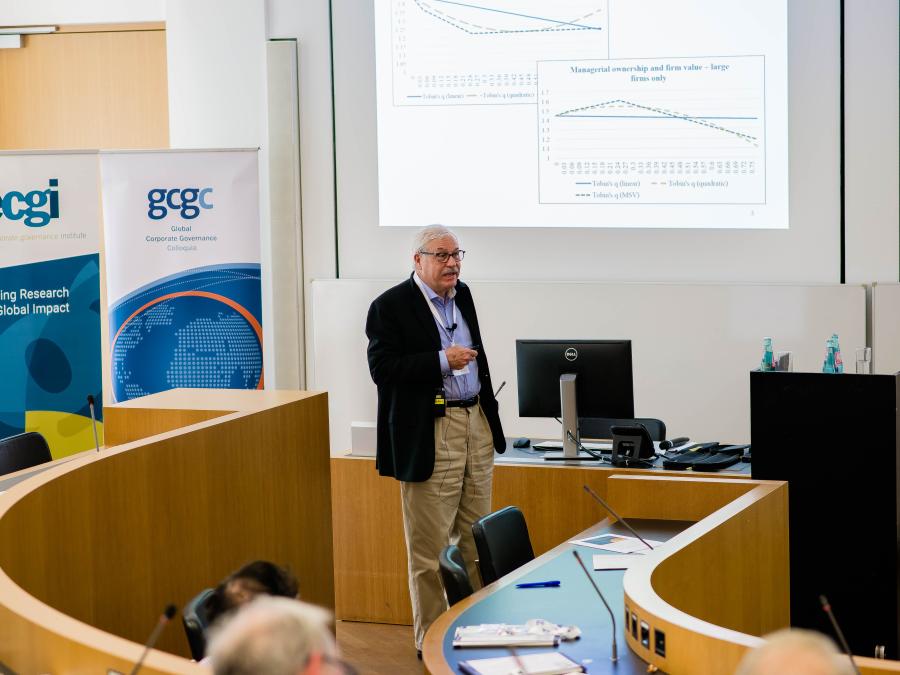

One focal point of the conference was the role of managerial and family ownership in firm performance, particularly under conditions of varying liquidity. The paper "Why are Firms with More Managerial Ownership Worth Less?" by Kornelia Fabisik, Rüdiger Fahlenbrach, René Stulz, and Jérôme Taillard challenged established beliefs by revealing a negative correlation between managerial ownership and firm value in a broad sample, contrary to previous findings. This discrepancy was largely attributed to liquidity: in illiquid firms, high managerial ownership persists, often correlating with lower firm value due to difficulties in reducing insider stakes over time.

Similarly, a paper on on Japanese family-owned firms, "Who is the Boss? Family Control without Ownership in Publicly-Traded Japanese Firms" by Morten Bennedsen, Vikas Mehrotra, Jungwook Shim, and Yupana Wiwattanakantang highlighted how founding families retained control through non-traditional mechanisms, even without significant ownership stakes. By leveraging intangibles like reputation, networks, and trusted employees, Japanese family firms continued to hold managerial power, redefining the conventional lifecycle of family-owned firms.

Active ownership by institutional investors also featured prominently. Research by Ruth V. Aguilera, Vicente Bermejo, Javier Capapé, and Vicente Cuñat on Norway’s sovereign wealth fund illustrated how a targeted approach to ESG engagement could shift corporate governance practices across portfolio firms. This was echoed in discussions about index funds, where Lucian Bebchuk and Scott Hirst’s paper "Index Funds and The Future of Corporate Governance: Theory, Evidence, And Policy,"revealed limitations in stewardship due to the financial incentives of index fund managers, who often under-invest in corporate engagement activities. Such findings prompted calls for regulatory adjustments to enhance the effectiveness of institutional investors as stewards of responsible corporate governance.

The conference also shed light on regional variations in regulatory impacts. In Commonwealth Asia, Dan Puchniak and Umakanth Varottil demonstrated that high RPT (related party transactions) rankings did not necessarily translate to better governance due to differences in enforcement and corporate culture.

A paper by Jinhyeok Ra and Woochan Kim on Korean firms' executive compensation transparency law showed unintended consequences, with executives avoiding disclosure through strategic pay adjustments and deregistration. The insights provided by these region-specific studies emphasized the importance of culturally and structurally sensitive regulatory approaches, as one-size fits-all models often fail to capture local governance nuances.

Programme

Registration

Welcome

Speaker(s)

Session 1: Session Chair- Elisabeth Bechtold

Investor Ideology

Speaker(s)

Discussant

Corporate Culture and Liability

Speaker(s)

Discussant

Coffee Break

Session 2: Session Chair- Kon Sik Kim

Panel Discussion I: Sustainable Finance

Moderator

Panelist(s)

Lunch Break

Session 3: Session Chair- Gen Goto

Active Owners and Firm Policies

Speaker(s)

Discussant

Coffee Break

Session 4: Session Chair- Ron Gilson

Eastern Medicine for Western Finance: Rethinking Financial Regulation

Speaker(s)

Discussant

Ends

Reception & Dinner

Arrival

Welcome

Session 1: Session Chair- Qiao Liu

Coffee Break

Session 2: Session Chair- Theodor Baums

Panel Discussion II: Banking

Moderator

Panelist(s)

Lunch Break

Session Chair- Theodor Baums

Coffee Break

Session 3: Session Chair- Holger Spamann

The Limits of Limited Liability: Evidence from Industrial Pollution

Speaker(s)

Discussant

Why Are Firms with More Managerial Ownership Worth Less?

Speaker(s)

Discussant

Closing Remarks & Reception

Speaker(s)

Speakers

Chang Zhang

Lucian Bebchuk

Vicente Cuñat

Enrichetta Ravina

Yupana Wiwattanakantang

René Stulz

Uwe Walz

Presentations

Gallery

Contact