The ECGI blog is kindly supported by

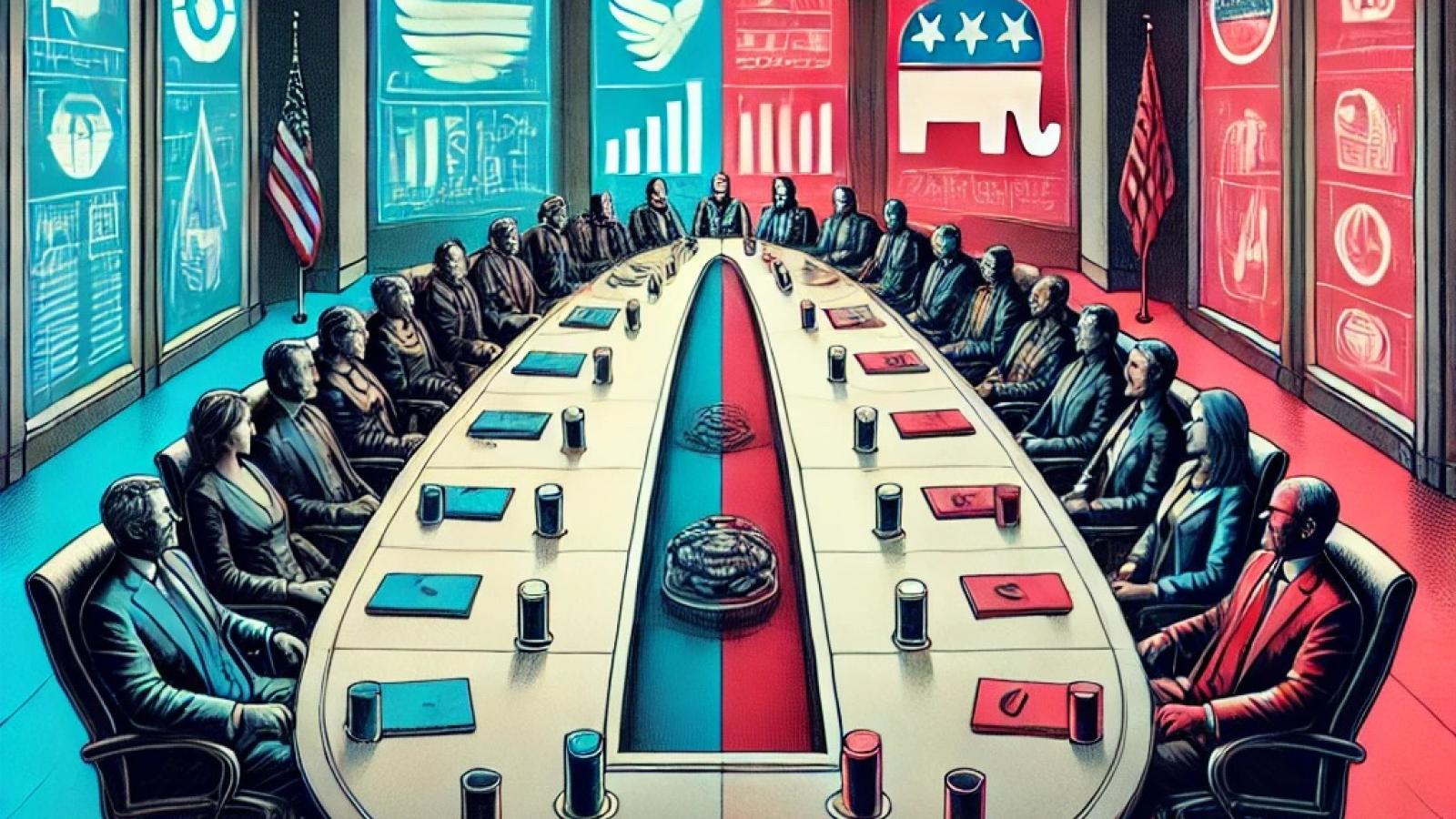

Has there been a “partisan realignment” within corporate America?

At the SHoF-ECGI Corporate Governance Conference, Professor Wei Jiang delivered a deeply insightful keynote on the multifaceted nature of board diversity. In her presentation, titled “A Diverse View of Board Diversity”, Jiang shared rigorous empirical data that challenged conventional wisdom around the benefits and outcomes of diverse corporate boards. The speech was data-heavy but offered profound lessons about how we view diversity in boardrooms today, particularly within the U.S. context.

Immediately striking was Jiang’s nuanced take on diversity. Rather than positioning diversity as an unqualified good, she emphasized that diversity itself is complex, involving trade-offs. As she pointed out, diversity is often pursued for its potential to generate robust decision-making by bringing together individuals with independent perspectives. This is critical in ensuring that board decisions are not only informed but resilient against rapidly changing market and societal landscapes. But, as Jiang reminded us, diversity is also about variance—something that finance professionals usually seek to minimize in decision-making processes. Her balanced perspective invited the audience to consider board diversity as more than just a box to tick—it’s a dynamic factor with both benefits and challenges.

A particularly interesting point from Jiang’s research was her finding on political diversity within U.S. boards. Historically, corporate boards in the U.S. leaned Republican, reflecting a pro-business, conservative ethos. But in recent years, this has shifted. Jiang’s study uncovered what she called a “partisan realignment” within corporate America. As boards have diversified along gender and racial lines, they have also become more politically aligned with the Democratic Party. In fact, when Republican-leaning boards appoint minority directors, these new directors are often politically progressive, further tilting the board’s political orientation toward the Democratic side. This finding suggests that efforts to increase gender and racial diversity in boardrooms are, perhaps unintentionally, contributing to a broader ideological shift in corporate governance.

Jiang’s analysis of the COVID-19 shock further illustrated the importance of board diversity. During the pandemic, boards with greater skill and experience diversity performed better, reflecting the practical value of having a range of expertise in times of crisis. While racial diversity also showed positive effects, it was skill diversity that had the most significant impact. This highlights an essential takeaway: not all forms of diversity carry the same weight in every situation, and companies need to consider what kinds of diversity are most relevant to their strategic needs.

Jiang’s speech reinforced the idea that diversity is not a one-size-fits-all solution. Her data-driven approach encouraged the audience to rethink how we measure and value diversity on corporate boards, and to recognize the complex trade-offs involved. By framing diversity as both a social and a strategic imperative, Jiang provided a thoughtful and evidence-based contribution to the ongoing conversation about how to build better boards.

The panel discussion following Professor Wei Jiang’s keynote further explored the complexities of board diversity and the practical challenges of implementing it across different organizations. With participants from various sectors, including Ann Grevelius, Wilhelm Mohn, and Catharina Belfrage Sahlstrand, the conversation delved into how large institutional investors like Norges Bank Investment Management and Handelsbanken approach the issue of diversity in board composition. Each panelist provided insights into their respective strategies for ensuring that boards are both effective and reflective of broader societal values.

The panel broadly agreed on the importance of moving beyond the more easily measurable aspects of diversity, such as gender, to focus on more nuanced attributes like skill sets, experiences, and perspectives. Ann Grevelius argued that relying solely on demographic factors risks creating boards that look diverse on paper but lack the functional diversity needed to drive real value creation. Wilhelm Mohn echoed this sentiment, explaining that while gender balance is a critical first step, boards must also prioritize a diversity of expertise to remain agile and effective in today’s complex business environment.

The panel also grappled with the growing trend of boards being required to recruit specific experts—whether in sustainability, cybersecurity, or other critical areas—often leading to a narrow pool of candidates. As Catharina Belfrage Sahlstrand pointed out, this can create challenges when boards try to fulfill both expertise and diversity mandates simultaneously. The discussion highlighted the need for a more flexible approach that balances the technical skills required for effective governance with the broader goals of diversity, ultimately ensuring that boards are equipped to handle the evolving challenges facing today’s corporations.

_______________

This article is Part Two of a five-part blog series covering insights from the SHoF-ECGI Corporate Governance Conference. Explore the rest of the posts: read Part One here, read Part Three here, read Part Four here, read Part Five here.