Does Sustainable Investing Work?

Can sustainable investing have meaningful impact, and, if so, on what and in what circumstances? Harald Walkate & Tom Gosling are on a journey to find out, with updates posted in the ECGI Blog. The series is sponsored by the Global School of Sustainability and the Financial Markets Group at LSE.

Introduction

There is an active debate about sustainable investing, what it is, and whether it works.

Is it just about managing the risks and opportunities created by society’s transition towards a more sustainable economy? Is it just about investing in companies that do things that align with our values and avoid those that appear to be causing problems? Or is it about impact – using our investments to contribute actively to making the world a better place?

Continue reading...

For a while it seemed like the differences between these perspectives weren’t important. Sustainable investing could outperform, align with your values, and achieve impact: win, win, win! But if it seems too good to be true it probably is. Recent politically motivated pushback in the US has combined with a short period of sustainable fund underperformance and legitimate concerns about fiduciary duty to create an environment where more rigour is required in answering the question: what is sustainable investing and what can it achieve?

The diversity of reactions to this increased scrutiny are interesting. Some have claimed that sustainable investing was really never about impact but all about managing financial risks and opportunities. Others have doubled down on the necessity of the investment industry being a force for good in meeting society’s challenges and have argued for a change in definition of fiduciary duty if that is what’s required to square the circle. Yet others have stuck doggedly to the win-win narrative: that what is good for people and planet must be good, at least in the long term, for your wallet.

Our view is that a significant number of purchasers of sustainable funds, or sponsors of sustainable mandates, do believe that in so doing they are having some impact on ameliorating some of the serious problems we face. This desire to have impact through investments has fuelled a sustainable investing marketing boom, as turning the pages of any weekend financial supplement will show you. Regulators certainly think so, with the EU, UK, and US all reviewing or introducing disclosure or labelling regimes relating to sustainable investment and anti-greenwashing rules.

But can sustainable investing have impact, and, if so, on what and in what circumstances? As long-term practitioners now flirting with academia, we see ECGI as being the perfect environment in which to have this debate; an environment that brings together the leading academics in the field with investment professionals and advisers who grapple with these issues day to day in their work. While we don’t claim to have the depth of knowledge and expertise of academics who have been producing cutting edge research for many years, our practitioner experience perhaps enables us to bring a different perspective: what does all this research mean in the real world?

So, in this project, which we are now introducing in this blog, we have reviewed a wide range of academic papers and practitioner articles on sustainable investing to try to answer the question: does it work? Although this is not intended to be a formal academic literature review (and so you won’t find hundreds of footnotes or references here) we do provide a short guide to the literature on sustainable investing. We hope that this will be a useful entry point for practitioners wanting to access and learn about the literature in this area.

Over the course of three articles we share our headline findings, hoping to provoke reaction, criticism, alternative views and, just maybe, some support.

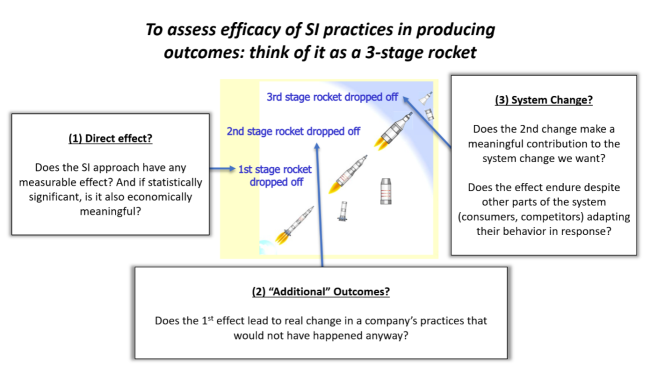

Three stage rocket

In the first article, Introducing the three-stage rocket analogy we describe a model for thinking about sustainable investing, which argues that for such practices to have impact, it’s not enough that they have an observable effect; they need to have an observable effect that leads to action with an enduring outcome. We find that a lot of claims for sustainable investing are based on studies that infer an enduring outcome from an observable effect. Using our analogy, the rocket may launch, but never reach orbit.

Launch to lower atmosphere

In the second article, Launch and reaching the earth’s lower atmosphere we view the evidence on the observable effects of sustainable investing and whether they lead to company action. We focus on the two most commonly cited mechanisms: engagement and affecting share prices or cost of capital through investment choices. While there is evidence of effects (stage 1 in our three-stage rocket analogy) there is less evidence of these leading to company action (stage 2). Or where there is, the scale of that action is often underwhelming, for example a disclosure commitment. Detailed study of the academic literature leads us to conclude, for now, that often whether there is an effect at all is questionable, and if there is its impact on company action is generally quite small. Overall, not a promising platform for addressing major externalities.

Reaching orbit

In the final article, Reaching orbit, we examine whether such effects and company actions that are a result of sustainable investing actually lead to enduring change at the system level or are simply undone by actions elsewhere. Here the evidence is underwhelming, although it is of course inherently hard to prove. We find very little support for the idea that sustainable investing is leading to broad system wide effects.

Just because sustainable investing cannot meet the most ambitious impacts claimed for it, does not mean it can achieve nothing at all. Taking what we’ve drawn from the evidence, we identify three areas of practice where we think sustainable investors can plausibly make a contribution. You will need to read the articles to find out what they are. But to give you a clue, they are all activities that contribute to creating an environment in which our problems can be solved rather than directly trying to solve them as investors. This subtle difference matters: we claim that by aiming for the stars, sustainable investing has failed to clear the launch pad. By adopting more modest goals, doggedly pursued, sustainable investing can help contribute to shifting our system to a more sustainable path.

What do you think?

We would like to hear your views on sustainable investing. Please consider sending your crisply written and argued opinions to ECGI — either in blog format (800 to 900 words) or as a 'Letter to the Editor'.

Email: blog@ecgi.org.

We look forward to reading your views.

Responses

This initiative is supported by

Bibliography

Additional Bibliography

- Bams, Dennis and van der Kroft, Bram (2024), ‘Tilting the Wrong Firms? How Inflated ESG Ratings Negate Socially Responsible Investing under Information Asymmetries’, available at SSRN: https://ssrn.com/abstract=4126986 or http://dx.doi.org/10.2139/ssrn.4126986

- Bauer, Rob and Derwall, Jeroen and Colin Tissen (2023) Private Shareholder Engagements on Material ESG Issues, Financial Analysts Journal, 79:4, 64-95, available at: 10.1080/0015198X.2023.2220648

- van der Beck, Philippe (2021),‘Flow-Driven ESG Returns’, Swiss Finance Institute Research Paper No. 21-71, available at SSRN: https://ssrn.com/abstract=3929359 or http://dx.doi.org/10.2139/ssrn.3929359

- Berg, Florian and Kölbel, Julian F., and Rigobon, Roberto (2022), ‘Aggregate Confusion: The Divergence of ESG Ratings’, Review of Finance, 26(6),1315, available at: https://doi.org/10.1093/rof/rfac033

- Berg, Florian and Heeb, Florian and Kölbel, Julian (2022), ‘The Economic Impact of ESG Ratings’, available at SSRN: https://ssrn.com/abstract=4088545 or http://dx.doi.org/10.2139/ssrn.4088545

- Busch, T. and Bruce-Clark, P. and Derwall, J. et al. (2021), ‘Impact investments: a call for (re)orientation’ SN Bus Econ 1, 33, available at: https://doi.org/10.1007/s43546-020-00033-6

- Ceccarelli, Marco and Glossner, Simon and Homanen, Mikael and Schmidt, Daniel (2021), ‘Which Institutional Investors Drive Corporate Sustainability?’, available at SSRN: https://ssrn.com/abstract=3988058 or http://dx.doi.org/10.2139/ssrn.3988058

-

Broccardo, Eleonora and Hart, Oliver D and Zingales, Luigi (2020). ‘Exit vs. Voice’, National Bureau of Economic Research Working Paper Series No. 27710, available at: http://www.nber.org/papers/w27710

- Eskildsen, Marc and Ibert, Markus and Jensen, Theis Ingerslev and Pedersen, Lasse Heje (2024). ‘In Search of the True Greenium’, working paper, available at https://papers.ssrn.com/abstract=4744608

- Flammer, Caroline and Giroux, Thomas and Heal, Geoffrey M. (2023), ‘Biodiversity Finance’ European Corporate Governance Institute – Finance Working Paper No. 901/2023, available at SSRN: https://ssrn.com/abstract=4379451 or http://dx.doi.org/10.2139/ssrn.4379451

- Gormley, Todd A. and Gupta, Vishal K. and Matsa, David A. and Mortal, Sandra C. , and Yang, Lukai (2023), ‘The Big Three and board gender diversity: The effectiveness of shareholder voice’, Journal of Financial Economics, 149(2), 323, available at: https://doi.org/10.1016/j.jfineco.2023.04.001

- Löffler, K.U., Petreski, A. & Stephan, A. (2021), ‘Drivers of green bond issuance and new evidence on the “greenium”’ Eurasian Econ Rev 11, 1, available at: https://doi.org/10.1007/s40822-020-00165-y

- Michaely, Roni and Ordonez-Calafi, Guillem and Rubio, Silvina (2023), ‘Mutual Funds’ Strategic Voting on Environmental and Social Issues’, European Corporate Governance Institute – Finance Working Paper No. 774/2021, available at SSRN: https://ssrn.com/abstract=3884917 or http://dx.doi.org/10.2139/ssrn.3884917

- Naaraayanan, S Lakshmi and Sachdeva, Kunal and Sharma, Varun (2020), ‘The Real Effects of Environmental Activist Investing’, European Corporate Governance Institute – Finance Working Paper No. 743/2021, available at SSRN: https://ssrn.com/abstract=3483692 or http://dx.doi.org/10.2139/ssrn.3483692

- Pastor, Lubos and Stambaugh, Robert F. and Taylor, Lucian A. (2024), ‘Green Tilts’, Jacobs Levy Equity Management Center for Quantitative Financial Research Paper, University of Chicago, Becker Friedman Institute for Economics Working Paper, Available at SSRN: https://ssrn.com/abstract=4464537 or http://dx.doi.org/10.2139/ssrn.4464537

- [1] Alex Edmans, ‘Evaluating Research’, available at: https://alexedmans.com/wp-content/uploads/2020/10/Evaluating-Research.pdf