Corporate Governance in the United Kingdom

The UK system of corporate governance is generally seen as an effective model that has influenced many other jurisdictions in Europe and Asia. This helps to attract international companies wishing to gain access to a wide pool of investors, who are reassured by the governance obligations placed on issuers regardless of where their key business operations are located. In this chapter we focus on UK-incorporated companies with a premium listing on the Main Market of the London Stock Exchange. Requirements are relaxed to a degree for companies that are only able (or only choose) to obtain a standard listing, or that are not UK-incorporated companies.

The United Kingdom’s corporate governance system comprises laws, codes of practice and market guidance. Mandatory and default rules and legal standards derive from common law, from statute (notably the Companies Act 2006 (the Companies Act)) and from regulation (notably the Listing Rules and the Disclosure and Transparency Rules published by the Financial Conduct Authority (FCA), which is a statutory body). Some of these laws and regulations derive from European law, but some are specific to the United Kingdom. The City Code on Takeovers and Mergers (the Takeover Code) also has an important role to play in control transactions, and has statutory force. Each company’s constitution, which will also impose governance requirements, has legal effect as a statutory contract.

The most important code of practice is the UK Corporate Governance Code (the Code), which is published and updated periodically by the Financial Reporting Council (FRC), which is also a statutory body. The current edition of the Code was published in 2014. The FRC has recently indicated that no substantial changes are expected until the next scheduled review in 2019. In 2010, the FRC also published the UK Stewardship Code (the Stewardship Code), which applies to the institutional investor community and not to companies directly.

Finally, guidelines from the key supervisory bodies and from the institutional investor community supplement these laws, regulations and codes of practice. The United Kingdom’s institutional investor community also regularly publishes and updates guidance on a range of matters, particularly those where a shareholder vote is required.

The bedrock of best practice corporate governance in the United Kingdom is the single board collectively responsible for the long-term success of each company including:

- a separate chairman and CEO;

- b a balance of executive and independent non-executive directors;

- c strong, independent audit and remuneration committees;

- d annual evaluation by the board of its performance;

- e transparency on appointments and remuneration; and

- f effective rights for shareholders, who are encouraged to engage with the companies in which they invest.

One defining feature of the Code is the ‘comply or explain’ approach: rules for companies with a stock exchange listing (the Listing Rules) require all companies either to comply with the Code or explain why they do not. The Code is issued with an acknowledgement of flexibility; this is in recognition of the principle that no single governance regime would be appropriate, in its entirety, for all companies. This approach does, however, rely on shareholder engagement to challenge non-compliance where appropriate. Nevertheless, in its January 2016 report on recent developments in corporate governance, the FRC noted that over 90 per cent of all FTSE 350 companies (the 350 largest UK-listed companies, by market capitalisation) reported full compliance with the Code, or full compliance with all but one or two provisions. In many cases, non-compliance is due to circumstances rather than deliberate choice. This confirms that the provisions of the Code are widely adopted by companies despite the comply or explain philosophy.

The Code states that an explanation for non-compliance should set out the background, provide a clear rationale that is specific to the company, indicate whether the deviation from the Code’s provisions is limited in time and state what alternative measures the company is taking to deliver on the principles set out in the Code and to mitigate any additional risk.

***

Resources:

More detailed information regarding corporate governance rules applicable to listed companies in the UK is available at https://thelawreviews.co.uk/edition/the-corporate-governance-review-edition-7/1140932/united-kingdom

For developments from the Financial Reporting Council (FRC): https://www.frc.org.uk/

*****

Contact

The Financial Reporting Council (FRC)

8th Floor

8th Floor,

125 London Wall,

London, EC2Y 5AS

T + 44 (0)20 7492 2300

Codes

Related Working Papers

-

Finance Series

-

-

Finance Series

Mapping Corporate Ownership and Control Changes for Public and Private Companies

Ettore CrociAndrea ViolaFederica Cupelli -

Finance Series

The Value of NGO Activism: Evidence from Sustainability Disclosures

Janja BrendelCai ChenThomas KeuschAnd more (...)

-

-

Blogs

Research Members

-

-

Philippe Aghion

Professor of EconomicsLondon School of Economics and College de FranceFellow, Research Member -

Franklin Allen

Professor of Finance and EconomicsImperial College Business School, Brevan Howard CentreFellow, Research Member, Board Member -

John Armour

Professor of Law and FinanceUniversity of Oxford, Faculty of LawFellow, Research Member -

-

Ulf Axelson

Professor of Finance and Private EquityLondon School of Economics and Political ScienceResearch Member -

Erik Berglof

Director of the Institute of Global Affairs (IGA)London School of Economics and Political Science (LSE)Fellow, Research Member -

Mike Burkart

Professor of Finance; Head of DepartmentLondon School of Economics and Political ScienceFellow, Research Member -

-

Brian Cheffins

S J Berwin Professor of Corporate LawFaculty of Law, Cambridge UniversityFellow, Research Member -

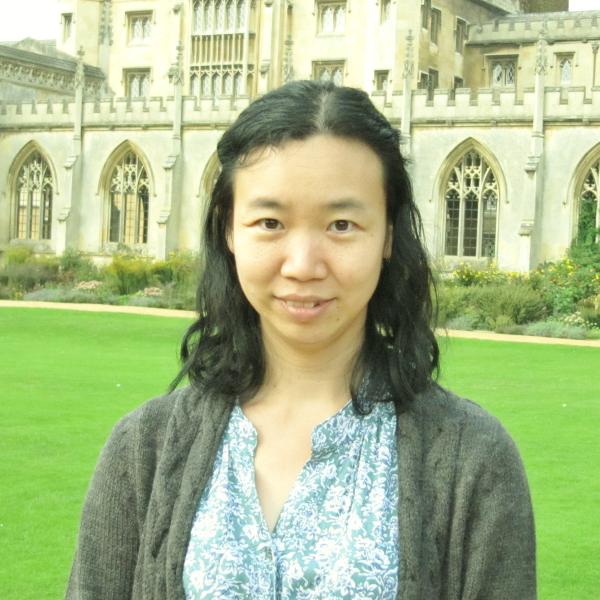

Hse-Yu Iris Chiu

Professor of Corporate Law and Financial RegulationUniversity College London - Faculty of LawsResearch Member -

Vicente Cuñat

Professor of FinanceDepartment of Finance, London School of EconomicsResearch Member