Corporate governance lies at the heart of our capitalist systems. It is the interface between capital markets and companies, between employees and executives, and between society and the corporate sector.

It refers to the way in which private and public companies, enterprises, entrepreneurship and financial institutions are governed and run in relation to their purpose, values, ownership, representation, accountability, financing, investment, performance, leadership, direction, management, employment, law, regulation and taxation.

It evolves continually and we strive to make it better.

About ECGI

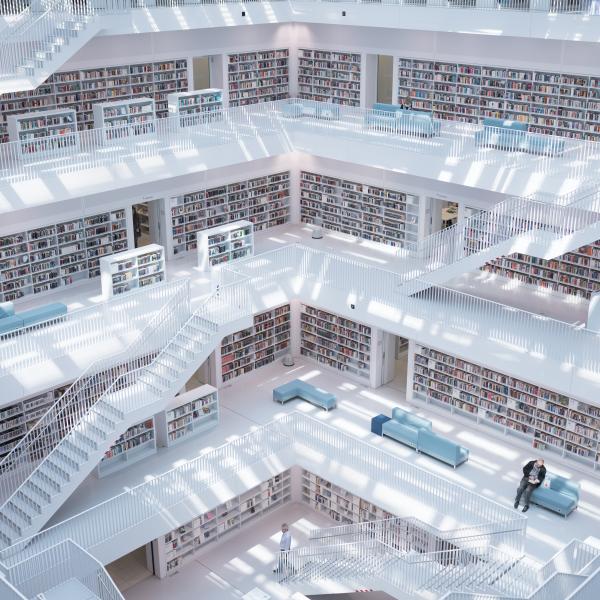

The European Corporate Governance Institute (ECGI) was founded in 2002, having been established on 15 October 2001 as an international scientific non-profit association under Belgian law. It was established to improve corporate governance through fostering independent scientific research and related activities.

Impact

ECGI is home to over 420 highly qualified research professors, from more than 28 countries, publishing work on corporate governance. The 2,000+ academic papers are the work of 2,358 authors and have accumulated over 2.3m downloads on a single platform.

Support us

ECGI is different to other networks because it does not have an institutional view. It is a pluralist organisation supporting many views which fuel discussion and debate. It performs a public good by making resources such as codes and papers freely available, and it fulfils the function of filtering content and authors, making it easier to find high quality research that can been cited with confidence. Supporting this work are many volunteers, sponsors and financial partners.