GCGC Session 1: Decarbonizing Institutional Investor Portfolios.

ECGI and Columbia Law School hosted the 2024 Global Corporate Governance Colloquium (GCGC) Conference on 14-15 June 2024 in New York, USA.

About the Session

Gen Goto (University of Tokyo) chaired the first session. Two papers were presented. Pedro Matos (University of Virginia and ECGI) presented the paper, "Decarbonizing Institutional Investor Portfolios: Helping to Green the Planet or Just Greening Your Portfolio?" (Vaska Atta-Darkua, Simon Glossner, Philipp Krueger, Pedro Matos) and was discussed by Marco Becht (Université libre de Bruxelles and ECGI)

Read the paper here: https://www.ecgi.global/sites/default...

For more information, please click the following link: https://www.ecgi.global/events/2024-g...

Session Summary:

The session discusses the challenges and strategies for decarbonizing institutional investor portfolios, focusing on engagement vs. divestment, the impact of public policies, and the role of institutional investors in addressing climate change. The discussion also touches on the importance of considering home bias, passive vs. active funds, and the effectiveness of different strategies in achieving decarbonization goals.

Top 8 Takeaways:

- The paper discusses challenges and strategies for decarbonizing institutional investor portfolios.

- Focus on engagement vs. divestment, impact of public policies, and role of institutional investors in addressing climate change.

- Importance of considering home bias, passive vs. active funds, and effectiveness of different strategies in achieving decarbonization goals.

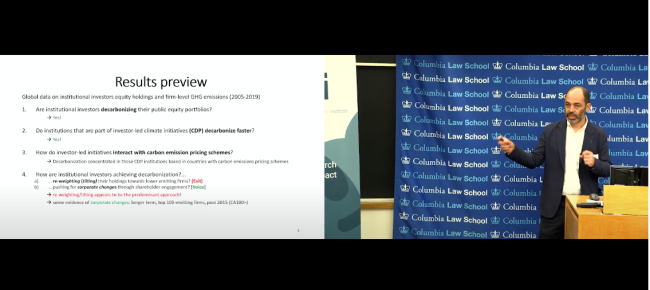

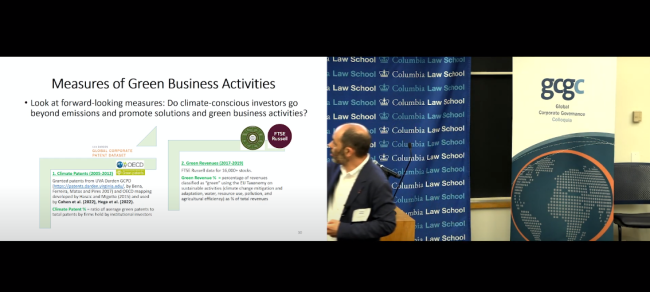

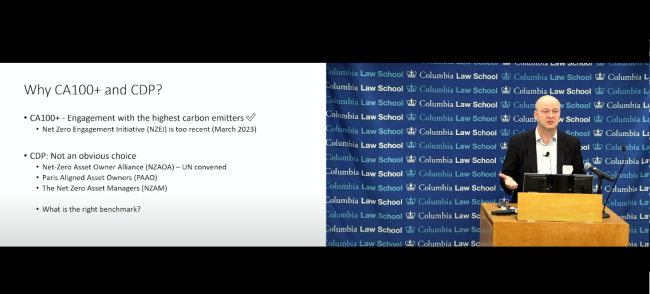

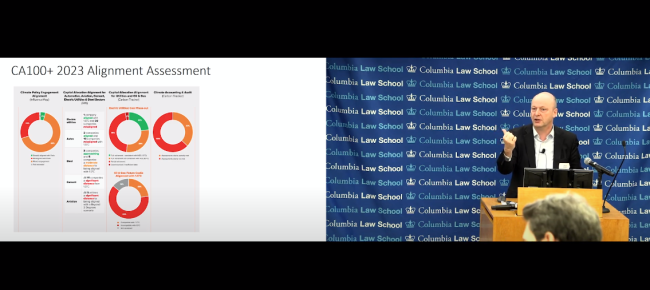

- Study looks at decarbonization efforts of institutional investors through disclosure initiatives like CDP and engagement initiatives like Climate Action 100.

- Results show that investors in these initiatives are decarbonizing at a faster rate compared to those not involved.

- The analysis includes the interaction of decarbonization rates with the rollout of carbon pricing schemes in different regions.

- The study also looks at the reweighting vs. engagement strategies in decarbonizing portfolios and the impact on corporate emissions.

- Discussion on the limitations of the study in terms of data granularity and the need for further research on decision-makers driving climate control efforts.

Video Timeline Summary

- The discussion focuses on the challenges and strategies for decarbonizing institutional investor portfolios, including engagement vs. divestment and the impact of public policies.

- Institutional investors have commitments to tackle climate change through disclosure and engagement, but their actions in greening their own portfolios are limited.

- Decarbonizing the global economy is a complex challenge due to political and economic factors, such as the legacy of developed economies and the rise of emissions in other regions.

- The Paris Agreement's 1.5-degree goal is likely unattainable, and the world is heading towards a 2-3 degree increase in temperature.

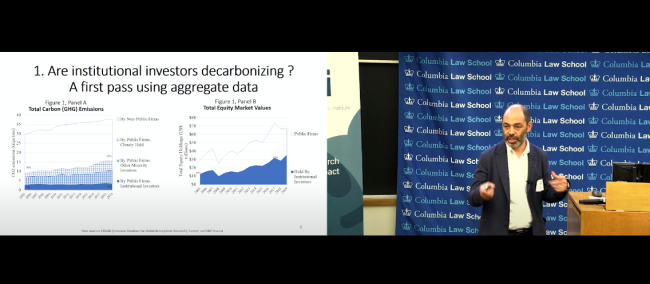

- Publicly listed companies are responsible for only 10 gigatons of the 50 gigatons of annual carbon emissions, making it challenging to significantly impact overall emissions through initiatives targeting these companies.

- The discussion focuses on the decarbonization efforts of institutional investors and the challenges they face in addressing climate change.

- The discussion focuses on two types of initiatives: disclosure initiatives like the Carbon Disclosure Project (CDP) and engagement initiatives like Climate Action 100+.

- The effectiveness of these initiatives is examined in the context of different carbon pricing schemes across regions.

- The public markets are naturally decarbonizing over time, but the question is whether these initiatives are driving further decarbonization.

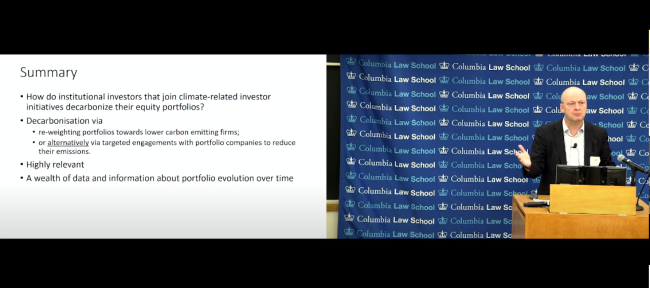

- Institutional investors who join climate initiatives decarbonize their portfolios at a faster rate, about 3% faster than the benchmark.

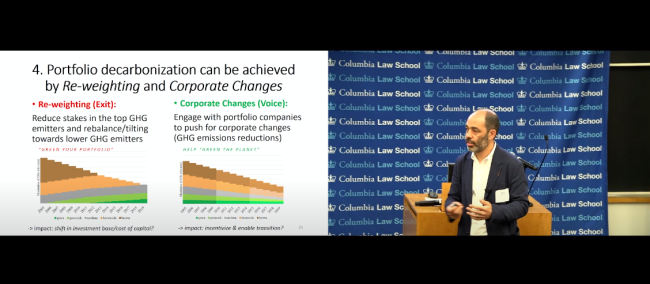

- Investors can decarbonize by either reweighting their portfolios away from "brown" stocks or engaging with "brown" firms to make them less carbon-intensive over time.

- The effectiveness of engagement strategies may be limited, with reweighting being the more common approach.

- Institutional investors have not significantly decarbonized their portfolios, as their share of emissions-intensive companies' shares remains low compared to their overall market share.

- Institutional investors that have joined climate disclosure initiatives like CDP have slightly higher decarbonization rates in their portfolios compared to those that have not.

- Institutional investors based in regions with carbon pricing schemes tend to decarbonize their portfolios at a faster rate than those in regions without such policies.

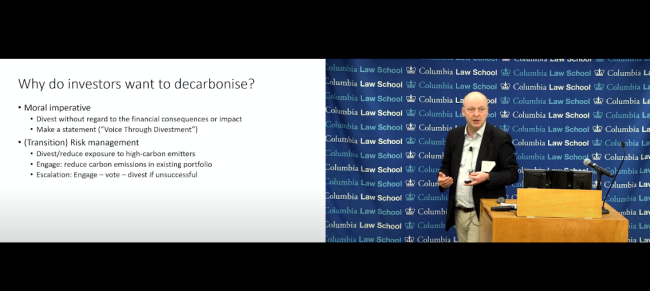

- Divestment vs. engagement: Reducing high-emission stocks and rebalancing towards lower-emitting stocks.

- Secondary market impact: Divesting may lead to American investors buying the sold shares.

- Transition support: Staying invested to help brown firms transition to less brown over time.

- The discussion focuses on the challenges and strategies for decarbonizing institutional investor portfolios, including the impact of public policies and the role of institutional investors in addressing climate change.

- The summary highlights the importance of considering factors such as home bias, passive vs. active funds, and the effectiveness of different strategies in achieving decarbonization goals.

- The discussion suggests that the initial focus has been on "greening the portfolio" rather than "greening the planet," and there is a need for further research and action to address the climate change problem.

- The paper discusses two main strategies for decarbonizing institutional investor portfolios: reweighting/divesting and engaging with companies to drive decarbonization.

- The paper frames these strategies as "Voice versus Exit," but the speaker argues that they are not mutually exclusive and can be usefully combined.

- The discussion highlights the challenges of decarbonizing institutional investor portfolios, including the risk of non-linear changes in climate concentration and temperature.

- The excerpt discusses the pledges made by different industries and countries, noting that the Paris Agreement targets are not sufficient to limit global warming to 1.5°C or even 2°C.

- Investors may choose to decarbonize their portfolios due to a moral imperative, regardless of the actual impact of their actions.

- The paper discusses strategies for decarbonizing institutional investor portfolios, including engagement vs. divestment.

- The paper examines the impact of public policies and the role of institutional investors in addressing climate change.

- The paper considers factors such as home bias, passive vs. active funds, and the effectiveness of different strategies in achieving decarbonization goals.

- The discussion focuses on the challenges and strategies for decarbonizing institutional investor portfolios, including engagement vs. divestment, the impact of public policies, and the role of institutional investors in addressing climate change.

- The paper suggests using a better benchmark for comparing decarbonization efforts, such as the SSMP index that tracks a sequential exit of high-emitting companies.

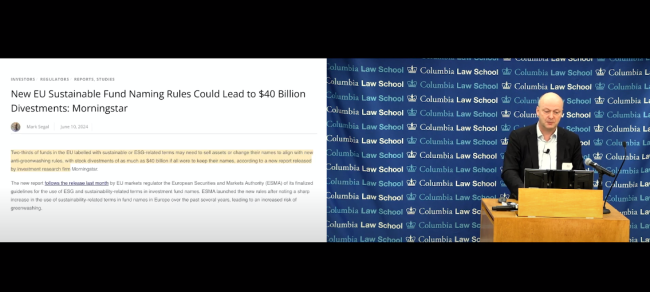

- The discussion also highlights the issue of greenwashing, with the asset management industry in Europe potentially needing to divest up to $40 billion to align with their stated decarbonization goals.

- The discussion focuses on the challenges and strategies for decarbonizing institutional investor portfolios.

- It explores the impact of public policies and the role of institutional investors in addressing climate change.

- The discussion also touches on the importance of considering home bias and the effectiveness of different strategies.

- The discussion focuses on the challenges and strategies for decarbonizing institutional investor portfolios, including engagement vs. divestment, the impact of public policies, and the role of institutional investors in addressing climate change.

- The discussion also touches on the importance of considering home bias, passive vs. active funds, and the effectiveness of different strategies in achieving decarbonization goals.

- The discussion highlights the need for a multi-pronged approach, including engagement with companies, policy changes, and the use of tools like emissions trading systems, to drive the transition away from fossil fuels.

- The discussion focuses on the challenges and strategies for decarbonizing institutional investor portfolios, including the role of engagement vs. divestment and the impact of public policies.

- The discussion also touches on the importance of considering home bias, passive vs. active funds, and the effectiveness of different strategies in achieving decarbonization goals.

- The discussion raises questions about the extent to which institutional investors can influence climate change and whether we are asking too much of them.